Felix Salmon points us to Arianna Huffington’s campaign to get people to move money out of the big four banks: JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo. (Over at Wells, which was “just” a $600 billion bank until it bought Wachovia, they must be wondering if it was worth the headache.) She suggests community savings banks here; Salmon suggests credit unions here; Uncle Billy also suggests credit unions here.

The Power of Conventional Wisdom

The week between Christmas and New Year’s is probably a good time to throw out half-baked ideas on topics I don’t know much about.

First, there’s been a lot of talk about the “lost decade” for stocks. The S&P 500 is below where it was a decade ago. Dividend yields bring you back up to break-even (the Vanguard Total Stock Market Index Fund had average annual returns of 0.18% for the ten years through the end of November, and that’s after about 0.1% in expenses), but inflation sets you back a couple of percentage points per year. (Vanguard’s S&P 500 index fund, however, was negative over those ten years.) James Hamilton, drawing on data from Robert Shiller, has some thoughts on why the stock market did badly; the fundamentals were so-so, but the big factor was that valuations were at their historical peak at the beginning of the decade.

Fairness

“What cannot be accepted are financial rescue operations that benefit the unworthy and cause losses to other important groups – like taxpayers and wage earners. And that, unfortunately, is the perception held by many nowadays, particularly in the United States.”

That’s Brad DeLong (regular blog here) in Project Syndicate (hat tip Mark Thoma).

But Brad, is it just a perception, or is it real? I think DeLong is saying it’s real, but I’m not certain.

What The Senate Must Do Now

This guest post was contributed by Charles S. Gardner, a former senior official at the International Monetary Fund. He argues we must not overlook the importance of extending effective regulation to the nonbank sector.

As Congressional action on financial industry reform shifts to the Senate from the bill passed recently by the House, the urgent need now is to fill the gaps in the piecemeal House approach. Regulators require an airtight scheme giving them clear responsibility plus tools to nip industry abuses early and drain the tendency to crisis out of world finance. This rare opportunity also must be seized to restore the Federal Reserve’s control of the money supply, eroded by decades of expanding credit creation by nonbanks. Continue reading “What The Senate Must Do Now”

Fear And Loathing In Manhattan

In the Washington Post Book World today, I review Andrew Ross Sorkin’s Too Big To Fail and two related books: Duff McDonald’s biography of Jamie Dimon (Last Man Standing), and Peter Goodman’s broader retrospective on the political origins and social impact of the crisis (Past Due).

If you think the crisis of 2008-09 was an aberration, or top Wall Street executives have learned their lessons, or our financial system is no longer dangerous, take a look at these books. Each of them separately explains part of how the people running our biggest banks have done so well; taken together, these books describe a pattern of corporate and government behavior which – in the aftermath of the Great Bailout of 2009 – points to serious trouble ahead.

By Simon Johnson

Holiday Season Takedown

Alan Greenspan has gotten innumerable takedowns, most notably in person by Henry Waxman. Binyamin Appelbaum and David Cho of the Washington Post are working on Ben Bernanke. Appelbaum and Ellen Nakashima already got James Gilleran (and, of course, there is the Photo). Now Zach Carter has nailed John Dugan. Some of the guns aren’t as smoking as one might like–Dugan only became head of the OCC in 2005, meaning he had less time to do serious damage, although he had established his bank-loving credentials long before. But he did what he could, such as preventing state regulators from gathering information (information!) from federally-chartered banks. Now, of course, he is lobbying Congress to protect his turf and kill the CFPA.

Why the Obama administration even acknowledges his existence is a mystery. I mean, Geithner is a centrist technocrat; I may disagree with him, but I see why he’s there. Dugan seems like the Stephen Johnson of banking regulation.

And to all a good night.

By James Kwak

Salespeople and Programmers

Tyler Cowen asks why pay across software programmers is not more unequal. He cites John Cook, who argues that differences in programmer productivity are difficult to identify and measure. Since I do know something about this (though not a comprehensive answer), I thought I would comment.

Cook contrasts programmers to salespeople: “In some professions such a difference would be obvious. A salesman who sells 10x as much as his peers will be noticed, and compensated accordingly. Sales are easy to measure, and some salesmen make orders of magnitude more money than others.” Although this is the most-cited example around (except perhaps for traders), I don’t actually think it’s true.

Should Ben Bernanke Be Reconfirmed?

Ben Bernanke’s nomination to be reconfirmed as chairman of the Federal Reserve Board passed out of the Senate Banking Committee and will next be taken up by the full Senate.

But, despite being named Time’s Person of the Year for his efforts during the financial crisis, the Bernanke nomination has run into strong pushback – both in terms of tough questions from the committee and in the form of a “hold” on the nomination, placed by Senator Bernie Sanders of Vermont.

The conventional wisdom among economists is that political control over an independent central bank is regrettable and should be resisted. We like to think of the Federal Reserve as a bastion of technocracy, with monetary policy steering a course between recession and inflation just on the basis of “objective evidence” regarding the relative balance of risks (i.e., if monetary policy stays too loose for too long, we’ll get inflation, but if interest rates are tightened prematurely, the economic recovery will stall.)

But the fact of the matter is that, in any well-functioning democracy, independence is earned based on credible and ultimately successful actions — not granted for all time and without conditions. The questions raised about Mr. Bernanke’s performance in office and his likely future actions are almost entirely appropriate – and focus attention on a major weakness in the case for his reappointment. Continue reading “Should Ben Bernanke Be Reconfirmed?”

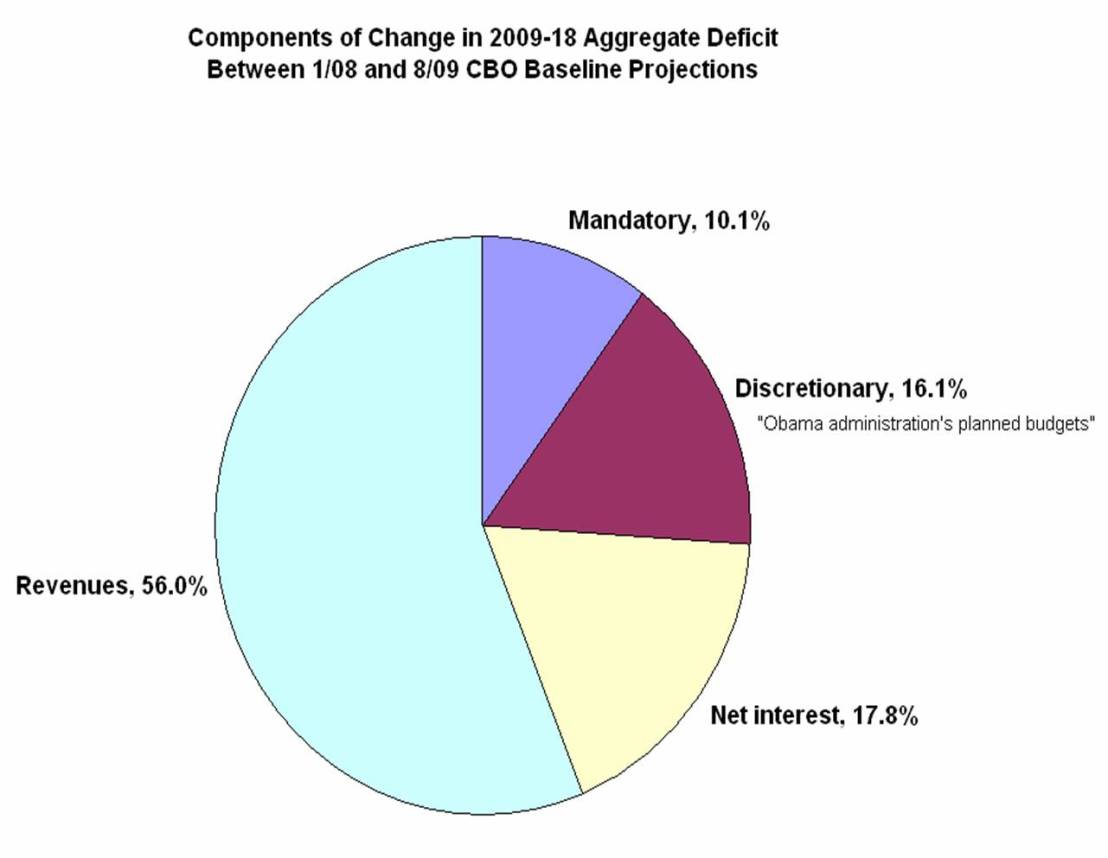

Whence the Deficit?

A couple of weeks ago I did a a basic calculation to see why the medium-term national debt picture has gotten so much worse in the last two years. There’s no new data I created; it’s just the difference between the January 2008 and August 2009 Congressional Budget Office projections. Here’s the chart, once again:

The Center on Budget and Policy Priorities (hat tip Ezra Klein) has done a similar exercise using CBO data, except they are looking at the annual deficit, not the aggregate deficit over a decade. Here is their chart:

Bernanke’s Reply: On The Doom Loop

Senator David Vitter submitted one of my questions to Federal Reserve Chairman Ben Bernanke, as part of his reconfirmation hearings, and received the following reply in writing (as already published in the WSJ on-line).

Q. Simon Johnson, Massachusetts Institute of Technology and blogger: Andrew Haldane, head of financial stability at the Bank of England, argues that the relationship between the banking system and the government (in the U.K. and the U.S.) creates a “doom loop” in which there are repeated boom-bust-bailout cycles that tend to get cost the taxpayer more and pose greater threat to the macro economy over time. What can be done to break this loop?

A. The “doom loop” that Andrew Haldane describes is a consequence of the problem of moral hazard in which the existence of explicit government backstops (such as deposit insurance or liquidity facilities) or of presumed government support leads firms to take on more risk or rely on less robust funding than they would otherwise. A new regulatory structure should address this problem. Continue reading “Bernanke’s Reply: On The Doom Loop”

If Wall Street Ran the Airlines …

New York Times headline: “U.S. Limits Tarmac Waits for Passengers to 3 Hours.” Just imagine …

***

Representatives of industry associations reacted negatively to the government action, warning that over-regulation would stifle innovation and harm the competitiveness of U.S. firms. “Requiring each plane to stock up on 0.5-ounce bags of pretzels and peanuts will only hurt passengers,” said Sam Tapscott of the Airline Roundtable. “Airlines will have no choice but to pass the higher costs on to consumers, who will see the price of excessive government intervention in every ticket they buy.”

More worryingly, some industry analysts warned of dire consequences for the U.S. economy. “Forcing airplanes to return to the terminal after three hours will reduce the efficiency of the entire air travel system,” said David Dell’amore, professor of flight operations at Harvard University. “Modern flight management algorithms minimize aggregate wait times and ensure the perfect balance of customer comfort and economic value-added.”

More Details

The financial reform bill that passed the House recently is full of surprises, not all of them bad. A contact pointed me toward an amendment introduced in committee by Brad Miler and Ed Perlmutter; it’s number 61 on this list. Basically, the amendment gives the Federal Reserve (“Board” in the text refers to the Board of Governors of the Fed) the power to prohibit a financial institution from engaging in proprietary trading not only if it decides that proprietary trading threatens of the soundness of the institution itself, but also if the Board of Governors decides that it threatens the financial stability of the country.

While this may seem overzealous, the point is to prevent a large financial institution with a government guarantee (of any kind) from putting most of its capital to work on its proprietary trading desks and taking lots of risks that might require a government bailout. The amendment does have exceptions allowing firms to, for example, make a market in securities that they underwrite, so securities underwriting is not in question here.

A Few Books

It’s holiday season again, which means that I have time to read books again, and you may be looking for last-minute gifts. (If you haven’t used it yet, you can get a free 30-day membership to Amazon Prime, which gives you free two-day shipping; you do have to manually cancel before the thirty days are up or you will get charged. Or you could go to a bookstore.) There have obviously been many books about the financial crisis, and I have only read a few of them, and I’m only going to mention a few of those here. You shouldn’t think of this as a “best of” list, just four books that different people may enjoy.

“It’s Certainly Not For A Lack Of Effort”

The fundamental divide in opinion regarding our financial system is: Are the people running “large integrated financial groups” hapless fools, buffeted by forces beyond their comprehension and control; or do they know exactly how to ensure they get the upside and the awful, sickening downside is borne by society – including through high unemployment.

Some light was shed on this issue by Monday’s meeting at the White House or, more specifically, by who didn’t turn up and why. Of the dozen bank CEOs invited, Vikram Pandit was supposedly busy trying to extricate Citi from TARP and asked Dick Parsons to attend instead – a wimpy but smart move, as Parsons is close to the President.

However, three executives – Lloyd Blankfein, John Mack, and Dick Parsons himself – did not show up in person and had to join by conference call. Their excuse was bad weather (fog) in DC meant that they were unable to fly in; Mack was quoted as saying, regarding their absence, “It’s certainly not for a lack of effort“.

But really there are three possible interpretations: Continue reading ““It’s Certainly Not For A Lack Of Effort””

Small Steps and Health Care Costs

Hey all you deficit hawks out there. Atul Gawande, the person of the year when it comes to health care, has a long article on the cost-cutting proposals in the health care reform bill (hat tip Ezra Klein). Gawande’s main point is that the long list of pilot programs and other initiatives in the bill are probably the best possible way to reduce costs in the health care system (which, if you missed the implication, is the only way to control long-term government spending–that or eliminating Medicare).

Indeed, it’s hard to see what else the bill could have done. Remember, we have a largely private-sector health care system (both insurance and delivery), which means the government cannot simply order providers to charge less. A single-payer system might be able to take such draconian steps, but Mitch McConnell, who claims, “Two thousand seventy-four pages and trillions of dollars later, this bill doesn’t even meet the basic goal that the American people had in mind and what they thought this debate was all about: to lower costs,” is the last person who would vote for single payer. And the Republicans are similarly against anything that allows the government to use the one big lever it does have–Medicare–to force lower cost levels.