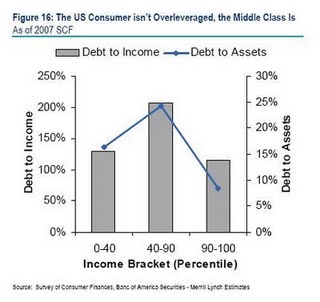

I want to point out this post from the LA Times, The consumer isn’t overleveraged — the middle class is:

That’s one conclusion to draw from a new Bank of America Merrill Lynch report this week, “The Myth of the Overlevered Consumer.”

The report hammers home what you might already suspect: The consumer debt problem in the economy really is a debt problem for the middle class. The need to work off a chunk of that debt will sap middle-class families’ spending power for perhaps years to come.

By contrast, the upper 10% of income earners face a much smaller debt burden relative to income and net worth. Those people should have ample spending power to help fuel an economic recovery.

Using 2007 data from the Federal Reserve, BofA Merrill defines the middle class as people in the 40%-to-90% income percentiles. It defines lower-income folks as those in the zero to 40% income percentiles, and the wealthy as those in the top 10%.

I looked at similar data here; what I find interesting is one of their conclusions, one I’m trying to think through these days. There’s a general assumption that, to whatever extent historically record-high inequality is present, it will almost certainly be gone post-recession. But what if it isn’t? What if this recession, and the recovery, will cement inequality in the United States even further? From them:

What’s more, on the asset side, BofA Merrill says the middle-class has suffered more than the wealthy from the housing crash because middle-class families tended to rely more on their homes to build savings through rising equity. Also, the wealthy naturally had a much larger and more diverse portfolio of assets — stocks, bonds, etc. — which have mostly bounced back significantly this year.

There are a lot of moving parts going on with the interaction between the top percents and the middle class, inequality and collapse, but it isn’t hard to see a story where the stock market picks up, housing is in decline for a decade, and we have a jobless recovery. I’m not sure how that would effect our quantitative measures of inequality, like the gini coefficient, but we could end up with much more inequality, and inequality that stings a lot harder than it did during the boom times.

I bring it up because, in a separate analysis of similar data, Zero Hedge made similar points in their massive weekend A Detailed Look At The Stratified U.S. Consumer (my underline):

…It is probable that the dramatic increase in savings as disclosed previously, is an indication that at long last the richest 10% of America may be finally feeling the sting of a collapsing economy. Yet estimates demonstrate that even though on an absolute basis the wealthy are losing overall consumption power, the relative impact has hit the lower and middle classes the strongest yet again…

The main reason for this disproportionate loss of wealth has to do with the asset portfolio of the various consumer strata. A sobering observation is that while 90% of the population holds 50% or more of its assets in residential real estate, the Upper Class only has 25% of its assets in housing, holding the bulk of its assets in financial instruments and other business equity. This leads to two conclusions: while average house prices are still dropping countrywide, with some regions like the northeast, and the NY metro area in particular, still looking at roughly 40% in home net worth losses, 90% of the population will be feeling the impact of an economy still gripped in a recession for a long time due to the bulk of its assets deflating. The other observation is that only 10% of the population has truly benefited from the 50% market rise from the market’s lows: those better known as the Upper class.

And to add insult to injury, the segment of housing that has been impacted most adversely in the current downturn, is lower and middle-priced housing: that traditionally occupied by the lower and middle classes. The double whammy joke of holding a greater proportion of net wealth in disproportionately more deflating assets is likely not lost on the lower and middle classes.

Consumption and savings might be hit relatively harder among the working and middle classes, as their primary investment vehicle deflates away while green shoots in the financial markets should kick start the healing for the upper classes. I don’t want to put my name too strongly on these predictions, because this part of the economy is very uncertain, but it’s a development I’m watching very closely.

And who are Bernanke, Geithner, Summers, Congress & Obama bailing out? The top 10%. Including themselves. No middle or working class bailout.

How about this? Why not bail ourselves out?

http://www.counterpunch.org/auerback08142009.html

And this?

http://www.counterpunch.org/hudson08182009.html

One effect of the concentration of wealth and power in fewer hands is that it can be employed in pursuit of aims which have no real benefit, and can be counterproductive. The Surowieckian argument is that this is inevitable, because the crowd will always be smarter than the individual, no matter how gifted. Accordingly, redistribution of wealth among the largest number of people is the best way to maximize the utility of the wealth and optimize outcomes.

This is a better response to critics than any appeal to “fairness”; but not any more likely to convince anyone.

One of the features of the brewing class warfare is that all of the wealthy are lumped together with the financial elite who have been the primary beneficiaries of massive transfers from taxpayers to the financial industry under the bailout.

As usual, those who earn wealth through productive business, and who have prudently avoided the destructive binge-investing and rent-seeking typified by parts of high finance in recent years, accrue all of the vilification and taxation that will be heaped on higher income classes, while deriving none of the benefits.

But I’m confused by the last quoted paragraph. Everything I’ve been reading lately has been pointing to high-end properties currently suffering the steepest declines in price (as a % – hence also certainly in real dollars). Who is right?

Time for a wealth tax. Flat rate, too. Steve Forbes likes flat taxes, doesn’t he? ;)

ZeroHedge ends their piece by lamenting that the higher taxation of the upper 10% that could fuel consumption will likely kill off any recovery.

Yet, based on the numbers they provide, the upper 10% has 57% of the wealth (based on the “average net worth” values) of the nation, yet only account for 42% of the consumption. The middle 50% of the population, which accounts for only 34% of the wealth, consumes 46% of the pie.

The lesson is that the middle 50% have a higher marginal level of consumption, and if you want to fuel a recovery with consumption, the middle 50% is where you should put the money.

Once again, I don’t really expect anyone, particularly those in that top 10% who hold the wealth AND the political power, to be convinced by this argument. But maybe Mike can talk to ZH and have them address it.

Unfortunately, the top 10% no longer engage in economically productive activities in the United States, so expecting them to lead a recovery is pie-in-the-sky.

One way of looking at this recession is to say that now that the rich own everything, there is nothing left to do. You can’t sell more stuff to people who have no money or credit left (only debts).

As consumers are 70% of the US economy, the only way to revive the consumer and the economy is to arrange a massive transfer of wealth back from the rich to the poor and middle classes.

Taxation, revolution, or what?

2007 was a looong time ago, folks! So many of us who were in (or were close) to that upper 10% have slipped out of it that I have to laugh when I think I actually worried about Obama’s new raft of taxes.

No, much of 2007’s “ten percent” club is no more–it is an ex-ten percent, it has ceased to be…okay you get it. It was battered by rising property taxes, slammed even harder by plummeting house values, knocked cold by stock market losses (which many people locked in by jumping out at the bottom) but the DEATH KNELL is the job losses and pay reductions that have been disproportionately borne by high-earning male bread earners (the MANcession).

If its redistributionist bloodlust that the nation is feeling, they’ll have to go further up the foodchain to the 15,000 families that walked off with two-thirds of the “10%’s” gains over the mythic past decade. Good luck nailing them down, however.

“The lesson is that the middle 50% have a higher marginal level of consumption, and if you want to fuel a recovery with consumption, the middle 50% is where you should put the money.”

BINGO! The BoA report comes to the same conclusion, but that’s really missing the marginal effect here…

The single most interesting thing about this article is the definition of the upper class as the top 10%. Like the change in measuring inflation (and thus GDP growth) that occurred during the 80’s and 90’s, we have morphed from defining the 3 classes as equal thirds into a teeny-weeny upper class, so that those living large with high 6 figure incomes, multiple houses, and kids in private colleges can be part of the suffering middle class. Economics has become positively Orwellian.

I don’t know how that figure is supposed to convince us of anything. That is showing us exactly six numbers and trying to convince us of a trend?

Show me the distribution! Break it down into deciles and show me the whole trend by income. Don’t just show me the mean value, I know there is a lot more information that went into the figure that is being removed or condensed unnecessarily because they assume the reader is dumb.

Finally, I know that in the middle category and have no debt. I bring the average down. What fraction of each of those averages is composed of people with no debt? How does that skew those averages?

I think many of those 10% are actually not doing as well, much of the economic literature shows that it wasn’t the top 10% that did really well, but the top 10% of the top 10%. So lumping a family with a combined income of say 200,000 with a family who earns 20,000,000 is not really productive.

However, I think the point to be made here is about relative versus absolute gains. While the rich have been hurt, they have been relatively less hurt then the poor and the middle class. With higher disposable income and a less battered net worth, the richest will be in prime position to buy up all the assets in the next 5-10 years, which will only make income inequality worse.

Also, another factor rarely brought up is how the rich are taxed. Really wealthy people don’t earn their income from jobs, their earn it from income produced by investments. Often these are taxed at the capital gains rate as opposed to the payroll tax rate which is higher. Just look at the tax rate Steve Schwartzman pays on his capital gains, but they function as a salary. Just at thought.

Politically the public will blame the Democrats (rightly or wrongly) and start to look to the government to lower taxes, as a replacement for increasing salaries, even though the government is in a similar debt hole.

Why, isn’t the whole problem we’re experiencing the fault of the average wage earne? After all, no one encouraged him to take on such unwieldy debt burdens. I mean who needs these folks anyway, there’s an economy of our own out there. Please, if you can’t pay, you can’t play, eh.

And this today from that quintessential expression of 21st century American public service, Timothy Geithner:

http://www.zerohedge.com/article/geithner-leave-banks-alone

The author writes: “it isn’t hard to see a story where the stock market picks up, housing is in decline for a decade, and we have a jobless recovery.”

Huh???

Would the author please elaborate on this bizarre logic? Please reply promptly, as my ever-helpful Merrill Lynch/Bank of America stockbroker is on hold …

To become wealthy generally means exploiting the working class – at least throughout history, that’s what wealth creation has meant.

We’ve outsourced our working class so that the exploitation happens in China and in India. So for our working class, there are no jobs. And for our middle class – many of those jobs have apparently been lost forever.

And the recipients of the bailout are the bankers. The rich bankers. That top tier. Because without that crack financial sector, we’re sunk. So we’re told by the powers in charge.

So yes, the current economic crisis will further institutionalize the class divisions in this country.

I will continue to assert that a “jobless recovery” is a huge crock of BS. There is no recovery without jobs.

what a horror scenario

for some years I have been fearing that class is back on the rise

green shoots in the financial markets …

Give me a break!

Defining the ‘wealthy’ to include ten percent of wealth holders is absurd. The ‘wealthy’ in America are the top one tenth of one percent, who own collectively as much as thirty percent of all financial wealth. Many of those in the bottom half of this allegedly ‘wealthy’ ten percent own a house, a 401k plan, two cars and a half dozen credit cards. Mostly, they are mortgaged to the hilt. Others own small businesses which generally speaking own them.

Attempts to tax the truly wealthy always fail by casting the net around those barely keeping above water. Bush got the estate tax repealed by talking about its effect on family farms. If you hope to find out who the wealthy really are, start the estate tax at fifty million and then listen to who squeals.

But isn’t it premature to conclude that financial assets will simply continue to recover in value? Despite the talk about green shoots, many economic indicators remain terrible, and without mass consumption there will not be the corporate profits that are, in the long run, needed to prop up stock prices. If working people have decreased incomes and decreased property values, the taxes that support government debt payments erode, and holders of that debt are at risk. Remember the Great Depression. After the initial 1929 stock market crash there was a run-up similar to what we have witnessed recently. Then it fell even further. It is entirely possible that there is another shoe waiting to drop, and if it does, last Fall’s DJIA of 8,000 could seem like a very fond memory indeed. I have seen predictions as extreme as DJIA down to 500 (yes, five hundred, not thousand) during 2010. It is far too early to know how this will end for financial asset holders.

The top 10% are the top 10% for a reason. If they are just barely getting by, what are the other 90% doing?

It’s also a mistake to assume they are the ones being reeled in by the last suckers rally.

Paul Saffo and the Institute for the Future in California predicated last year before the crash that by 2050 the good ole USA will not look like it does now. He predicted that it will be broken down into smaller city/region countries. For example the entire West Coast would be one nation.

I couldn’t for the life of me see the motivating factors to drive a country to disintegration. Now I do. Talk about a Revolution….wasn’t that a song Woodstock?

If the country is bankrupt, and the rich through their lobbying interests are in control, what do you think will be the long term outcome?

The American people are not stupid. Eventually they will stop worrying about gays, guns and grandma and figure out how the corporate oligarchy running this country has robbed them and their children.

The rich don’t care because they are invested in shorts, hedge funds,and globally. The whole middle class can sink and it won’t matter to them financially. What will matter if that wakes up and realizes that all politicians are bought off by the rich.

Well they’ve managed to prosecute one of the, what was it, 50,000? american offshore UBS account holders. Things are looking up!

I don’t see how the buying Bob Guccione’s house for tens of millions of dollars is going to help the wider economy. I don’t see how exotic-bicycle-riding ex-AIG FP scumbags living in London help the wider economy.

I really don’t want to wait to find out exactly just how much the top 10% won’t be contributing to our economy. You see, they generally move their money elsewhere, and spend it elsewhere. I’m quite sure “elsewhere” will be glad to lend us some money, however. And since debt=money, we’re rich!

While not exactly destitute, the top 10% (those earning over $75,000) are not the ones to worry about. It’s the top .1% as Jake Chase mentioned above that are grabbing all the dough.

But if you use this line of argument then you should actually place all your money with the really poor who guarantee a 100% marginal propensity to consume.

Is it not more important to give the money to those that do something more with the money than consume?

I wonder how much of the top decile, the one BoA says have the purchasing power to fuel a recovery, are in or nearing retirement? Maybe this chart would look the same grouped by age and merely reflect the permanent income hypothesis. Maybe the wealthy have even less slack after adjusting for this. More importantly, the study (or at least the article on it) doesnt even compare these ratios through time. Which cohort’s debt levels have grown the fastest on the margin? Bring back Rosie. This analysis is lame.

The American people have been manipulated by the wealthy during the entire history of this country. If that is not a definition of stupid, what is?

If the consumers don’t have the money, they can’t buy what the producers are selling. If the producers don’t have the money, they can’t front the costs to make what the consumers want. Right now, there is world overcapacity. Therefore, give the money to the consumers.

PK: I was merely responding to the ZH analysis on its own “merits”, using its own data.

The larger question is the one you pointedly ask, “Do we really want an economy driven 70% by consumption?” It would be great if we could, as a nation, have a sustained, reasoned, informed debate about what we want our economy to look like for the next 25-50 years (or more). But, watching the health care “debate,” I don’t expect it to happen.

The lower half of that bottom 90 percent are living on the streets right now.

“The American people are not stupid.”

Depends what you mean be stupid, but the fraction of poor who consistently vote against their economic self interest is large, particularly in southern states.

http://www.fivethirtyeight.com/2009/02/rich-and-poor-still-vote-differently-in.html

But since I know that numbers are never as convincing as stories…

On a personal note, my wife knows someone from that region who had cancer, was on medicaid, survived ONLY because of medicaid, continues on disability and child support, and _rabidly_ despises Obama and all “government socialism”.

The ability of people to build cognitive walls inside their own brains to prevent themselves from confronting the hypocrisy of their own lives is tremendous.

Do not underestimate the power of stupidity.

I live in a certain part of the country where, believe me – God, gays, and guns – still rule the world. We can be in the middle of WWIII and everyone in the country is unemployed, but it won’t mean a thing because God, gays, and guns are where its at. And the ironic thing is that many who put the 3 G’s on a pedistal are the very ones who are down the most.

Amen, brother. We are unfortunately still fighting the Civil War down here. Or “the waaaah o’ nooorthern aGGrezuhn,” as it is often called. Think we still need to resolve this one from 135 years ago before we start tackling things like our current economic mess. I went to a war reinactment for the 140th Anniversary of Bentonville (look it up if you missed history class) and there were 10,000 sitting at the edge of their seats hoping that the outcome of the final battle would change. Needless to say, the soldier actors got it right and history remains the same. But there were 10,000 pissed off people, though.

Agreed. I think I said 10% because I was thinking about how more and more meatheads were using a cheeseball financial adviser, creative accountant, or lawyer, to help them hide their income, into the 1-10% range. Regardless, that income is negligible when compared to the top percentiles.

I’m glad you posted this one. It’s a problem that I have been aware of intuitively for a long time, and one that has been festering since long before we had the present crash. What happened nine months ago (actually more than a year in real terms) has only exascerbated the problem. What no one is talking or writing about is the upshot of this problem of income inequality and what it will mean in the kind of recovery we face.

I believe that the middle, as defined, will actually find itself gradually slipping much further in purchasing power and general financial wellbeing. This is because they no longer have any cushion, and will be forced to exercise extreme measures just to maintain stability. Sooner or later what may really tip them is the tax burden that will grow out of trying to keep the big boys in business, and the burden of an unrepaired health care system, as well as a larger proportion of retirees to support. Because they won’t be able to be proactive consumers, the top end will suffer more and more, because the very things that they rely upon (that marvelous diversified portfolio) will no longer support them, and their tax burden will also increase fairly dramatically because they will be (logically) the only segment with the financial wherewithal to support the huge government debt burden.

All things considered, this could lead to real social upheaval, and interestingly to a real reshaping of the makeup of the Congress we will be electing, with a much stronger tendency to support candidates with less and less connection to the monied interests. The next 3 to 5 years could be extremely painful for all, and could actually result in what could be a quiet or even very loud revolution at the populist level.

After all, the youth in America is now in position to suffer greatly for the excesses of the past 10 to 15 years, and they will be growing strong voices and be looking to find their own versions of the American dream, all with great consequence for our traditional status quo.

Don’t throw out your guns.

Since we’re in the business of talking about the “aggregate demand problem” (as if that were a problem), then the solution is monetary – and that means continuing to expand the monetary base as the population continues to deleverage. Ideally, in an internationally coordinated fashion to prevent an anti-US dollar carry trade.

In a situation where EVERYONE is trying to save as much as possible, wealth concentration can occur. This is almost mechanical – those individuals with lower costs of survival (as a percentage of total assets or income) accumulate at the relative expense of those with higher costs. This is one of the pernicious results of deflation.

The problem isn’t excess SAVINGS per se, but rather insufficient INVESTMENT. In other words, a breaking of the savings/investment equillibrium created by excessive demand for liquidity and low expectations of future growth. All households, especially those with better balance sheets and income, are deleveraging. The structural economy is reliant on consumer spending. Worse, the expectation of future inflation (and dollar devaluation) creates capital flight abroad – which is what happened in Japan. That is to say, Japanese saving funded investment, but because of the carry trade that investment did not happen in Japan… It supported low interest rates in the US. So they had a lost decade, and the US had a massive bubble.

(Tell me again about the virtues of a completely free international trade/capital markets?)

The ideal US policy response would be a rapid one-time increase in the monetary base and devaluation of the dollar that is sufficient to create the expectation of a stable (or even re-valuing) dollar so people want to keep investments in dollars. And this needs to be accompanied by the expectation of fiscal discipline to prevent more debt accumulation, which would require higher taxes pretty much across the board.

The US’ consumption-driven economy is not stable. Many anti-strong-govt. folks have laughed at Europe, noting that their incomes may be nominally higher and their quality of life/health/happiness measures may be better (World Bank Propaganda!), but they have smaller houses and drive smaller cars!

——

And since we’re focusing on the top 10%, probably the bigger issue is that _among_ the top 10% there’s been further wealth consolidation. This is because different households in the top 10% were impacted differentially by the immense volatility. Those who began the crisis out of housing/stocks did quite well, particularly if they rebalanced in the spring. Many younger high earners who began the crisis using the recommended stock breakdown by age (e.g. 100% – age% in stocks) did quite poorly, particularly since they started households in the last 5 years.

My guess is that if you broken down the strata within the top 10% you’d see massive consolidation and many falling out of the top 10%. (Likewise in hedge funds… on the of the major changes in the last few decades compared to prior recessions is the ability to profit from downside movements – notably, massive naked shorting. While this is strongly defended by many financial experts who argue that shorting is a valuable activity, it polarizes returns among investors. Rather than everyone moving up or down in lockstep, or allowing some variation by asset class, we can have some individuals – or hedge funds – profit immensely on downside movements.)

BTW, A GREAT DEAL of this dramatic wealth consolidation can be laid at the feet of the Fed… which held to a tight money policy in Summer of 08, and then kept money relatively tight through March of 09. Many, many mom-and-pop buy-and-hold investors that survived the September purge bailed in October, and then many more bailed in February. And the economy shed a few million jobs. Until FINALLY the Fed decided that (yes) things were in fact just as bad as they seemed, and followed through with its pledge of QE (that it cravenly prayed it would not have to use).

A lot of good comments. As has already been said… the data is 2 years old and thus outdated…The top .1% is a completely distinct income class. But I absorb nothing of value from this BofA report. Of course the top 10% has a lower debt/disposable income ratio, ‘like dah!’. Comparing the 2007 numbers to some historical yardstick might have been informative, but they didn’t. I would need to know if this gap is widening or shrinking or staying the same before even beginning to formulate an opinion regarding it. I suspect the lower percentages for the bottom 40% have more to do with the definition of income (e.g. not including public assistance and earned income credit, etc…) or any one of half a dozen other variables than results in statistical paradoxes, than it has to do with behavior patterns. the LA article does not even define ‘disposable income’ . IMO the BofA report is worthless.

“give the money…” What money? You mean the Monopoly money the Fed has been conjuring up? Or do you mean money borrowed from the ever-more-reticent Chinese?

doesn’t that annoy the top ?% when they have to pass by the destitute?

are there any public utterings about them besides “I worked my way up so everybody can”

it sure spoiled my evening out when I saw for the first time a man sleeping in a doorway in affluent Frankfurt

they’ll save “it” all by inventing the conspicuously consuming robot who/which will become the must-have for the top ?% and will keep all the business alive

– maybe they’ll even make them as specialist – one roaming the earth to buy all the handbags he can get, one all the earrings – will they allow the robots to have their own Ferraris though?

much less messy than genetically standardized servants (I’m reading “revisiting brave-new-world http://www.huxley.net/bnw-revisited/index.html) and I remember now that there was nonsense in it which turned me off Huxley

like this:

Huxley is paddling the nonsense of deteriorating biology in humans as fresh revelation in 1958 ignoring that thru all the times for which there is a written record big minds have complained that the quality of children is deteriorating because the “wrong” people get them because children with “defects” are kept alive etc. etc

…while at the same time writing a lot of well-observed stuff (it’s nice to read about the world of 1958 in America being described by a doom-sayer who obviously likes America and wants it saved that at least is the tenor during the first 6 chapters)

I dare you to tell me a time and a place where the top ?% did not manipulate the rest

– Americans are not more nor less stupid than all the other people on earth

they just have a knack of doing quite a number of things better than all the current rest and that unfortunately and obviously applies also to the wrecking of their finances

“Do not underestimate the power of stupidity.”

Orwell convinced me in the Road to Wigan Pier as well as in his Notes to that book that it is the upholding of dignity which leads to such “stupid” behaviour. http://en.wikipedia.org/wiki/The_Road_to_Wigan_Pier

strange! my “normal” Orwell site is off-line but the Russians have a very good one http://www.orwell.ru/ – ooops, it looks like they’ve stopped upkeeping it –

Brave New World would be a right name for it if the world were into risk-taking but in fact it is totally immersed into risk-aversion… so perhaps a Coward New World would be more appropriate?

But don´t worry, soon we will all have our individual gene-mappings on Facebook; and the insurance regulators, following the lead of the financial regulators in Basel, will impose on the insurance companies special capital requirements when they insure risky-health profiles; and so these risky health profiles will find it more expensive still to get insurance… and Darwin will explain the rest for you.

And having learned from the 08 crisis the health raters will be specially scrutinized and regulated, and not paid by the raters, so that we can rest assure that they do not smuggle into our society a little defective and harmful gene.

Pure bliss!

“problem of income inequality”

between 1978 and 1980 I realized that I had been moved down the social ladder while holding the same kind of job.

Before that a well-remunerated secretary/assistant could easily afford the rent for any appartement house in Wiesbaden, then the capital of German millionaires (thank you US-Air-Base*))

between 1978 and 1980 they built a whole bunch which was out of my reach if I still wanted to lead a comfortable life

it didn’t matter much to me since I prefer to live out of town in the country anyway but it had been nice having a choice

as we always tend to lag behind the US maybe this happened some years earler with you …

*) maybe Iraq would have been a sounding success if the US had promised from the start to become occupiers – isn’t it likely the Iraqis knew how well Japan and Germany did under American occupation/tutelage – maybe Iraqis started the whole thing to give you a pretext to stay and the hatred is just propaganda …

“the top end will suffer more and more”

which top end????

top ends do not suffer unless they act very stupidly they know how to evade unpleasant developments

– the normal ones or the real ones the ones with the Carribean or artificially built islands: I’ve read that some guys from Silicon Valley have been thinking of building those in extra-territorial waters (somehow I do not mind the stinking rich of Silicon Valley while I would like to sream in my screechiest voice at those gamblers) – of course those islands could easily be bombed to smithereens but what about all the servants who just earn a living there.

“Europe”

I do not yet put my bet on us – with the Kurzarbeitergeld “short hour working compensation” (I assume other countries having similar cushions) still in action probably nobody knows what will happen to unemployment if that fades out and the much more costly unemployment insurance has to take over

– puzzling to me though: tourism has been doing well even increased a bit on the Baltic this summer while according to the Economist the Mediterranean suffered – but there is no difference in price between a low cost Mediterranean and a low cost Baltic vacation for a German so why all of a sudden the enthusiasm for staying in the country?

“profit immensely on downside movements”

wasn’t it Rhett Butler/GWTW who taught me that you can get as quickly rich in a society moving downward as the other way around? – he made his fortune by smuggling if I remember correctly i.e. by dubious action doing business with both sides equally

how about cashing in from the Germans who never gave up on saving during the crazy years but seem to get a taste for it now – so hurry !!!

– because we have this inbred fear of inflation it seems I am not the only one who feels an urge to spend before the price hike begins

you have a kind of moral right to demand pay-back for your largesse all these years (I don’t think we paid in full for that military protection) so hurry up before a lot of it ends up in other countries’ pockets supplying us with their goods

do not get your first paragraph – to me it looks like the gamblers are still at it mightily – how can that be risk-averse behaviour

but must defend Darwin

– the British unanimously attest that he did not proclaim the survival of the fittest – in fact from all the podcasts I have heard these past months on him I get the impression that he was cautious delaying and delaying wanting to get it right – and wanting to somehow respect the feelings of his religious wife

I do not remember who plastered that survival of the fittest on him but the Darwin himself seems to me just not having been simple enough for such a simple statement.

Europe is hosing itself because of the ECB’s tight money policy, the only rationale for which is either ideology or a desire to make the Euro the world’s reserve currency. It does, however, understand that there is such a thing as “public investment”, and that an excessively consumption driven economy ain’t such a good thing.

The belief in the US going into 2006 was that if something happened, it _must_ have been socially optimal.

StatsGuy

you should have read all the hyperbole of our MSm in the run up to the Euro

– everybody reading only German should have been excused for believing the down-turn of the US and the establishment of the European Empire was imminent a foreclosed certainty.

The only piece I remember vehemently protesting was Frederick Forsyth of Shakal-fame by telling us that Germans would end up paying the bill for the others. I am not qualified to judge on the finance part but the resurgence of the dream of European world power all over the gazettes disgusted me enough to remember it well.

Oh yes I know that most experts, including Nobel Prize winners, speak of this crisis as resulting from excessive risk-taking… but that is just because they have become so intellectually lazy.

Anyone observing that the losses originated from the financing of the safest assets, mortgages on houses, in reputably the safest country, the USA, and by means of absolutely no risk-instruments, all rated AAA; should necessarily have to conclude that what happened was instead a monumental misguidance of highly risk-adverse capitals.

And if I have misunderstood Darwin, sorry, and I then correct the reference to be to the misunderstood Darwin.

“a monumental misguidance of highly risk-adverse capitals.”

I have tried to figure out for decades what the little Nazi within me really wanted. I did that way before Christopher Browning’s “Ordinary Men” hit us because I could never believe that they were all monsters and totally different from you and me – so I wanted to know for sure with all my heart what could trigger me into mass-murder-complianceship.

Finally the answer turned up and it was amazingly simple and hasn’t been in doubt for at least 20 years of regular probing.

The answer was Sicherheit=Security, Safety, Protection, Certainty

recently though another thing has shown up to confuse my certainty: I am susceptible to the attraction of Sarah Palin, giving voice to all that built up class difference rancour seems to resonate with me while I hold opposite convictions to any of hers

– I really surprised myself when I realized that my gut wanted to march with her – having never before in my life experienced any feeling remotely similar about a wanna-be-leader to the one she evokes

Silke, please, keep digging.

Per

“The American people are not stupid. Eventually they will….figure out how the corporate oligarchy running this country has robbed them and their children”

But some want them to be stupid, so as to have them fall for such a simplistic answer

The problem with any simplistic answer as with any wall is that you can never be sure you end up on the right side of the divide.

Great comment but with so much talk about Black Swans lately can you really blame them for hoping for a different outcome?

and the problem with the complicated answers is that you’ll end with a lot of cats chasing and catching their own tail i.e. Catch 22s

– so after looking coolly and extensively at all the facts somewhere along the line you have to take sides fully aware (if you are honest with yourself) that you have no inkling what the consequences will be but on the other hand if you want to remain a decent person be willing to take real responsibility for the consequences (got the idea from one of Jan-Willem van de Wetering’s Inspector Saito stories) i.e. keep working on acquiring karma

– if you are into pursuing real evil aims your decision making will probably be a lot less complicated as you know from the start which side you want to be on

if you are not willing to jump into the unknown called unintended consequences you have to try sitting on the fence hoping it will not crumble before you’re thru

only 135 years and you want them to have changed already

– look at how the Serbs keep going on about their defeat on the Amselfeld. If I remember correctly that’s about 600 years ago and they are still willing to kill and die for it

– once you allow people to settle down somewhere or move them forcibly from a former settlement ground they will cherish any old rancour

– I remember Bruce Chatwin writing something a bit confusing about humans really made to be nomads but even they have their accustomed sommer and winter grounds, do not just roam on a whim

– maybe the hobo is the man of the future, Woody Guthrie made at least music I liked

And indeed there are many fences where many have sat in comfort for quite some time crumbling now.

“And to add insult to injury, the segment of housing that has been impacted most adversely in the current downturn, is lower and middle-priced housing: that traditionally occupied by the lower and middle classes.”

And do you know why? The segment of housing that had benefited most in the previous housing boom, is lower and middle-priced housing: that traditionally occupied by the lower and middle classes.

The middle class benefited most from the housing boom, and used their houses as ATMs with which to buy big screen TVs. Those who benefited most from booms are hurt most by the busts.

“Those who benefited most from booms are hurt most by the busts.”

interesting,

now the financiers are biggest victims of it all

– measured by the amount of money lost that may even be true but measured from the amount of money left when the bleeding stopped or will stop it seems to spin the story just a wee bit.

When I still wanted to buy an appartement for my time as a retiree, I realized with every offer I looked at how true this piece of advice is:

when choosing property the location matters and next again the location and then again location – after that you may consider other parameters

– after having gotten over the disappointment of not owning my own home*) because paying anything beyond what I would have to pay in rent for my remaining decades seemed frivolous to me

*) thereby becoming finally recognizably respectable

RE: all the comments on stupidity and people blindly opposing their own economic interests — Read Thomas Frank (http://tcfrank.com/) who covers this topic in depth, including how the tendency has been captured and to a certain extent manufactured by the Right.

The rich were disproportionately rich in 1930, too. How’d that work out?

your question unveiled to me that I have not read a novel or non-fiction ever which told me

therefore I guess that those who managed to stay rich stopped parading it

Bob_in_MA: “The rich were disproportionately rich in 1930, too. How’d that work out?”

We did not bail them out back then.

Silke: “I do not remember who plastered that survival of the fittest on . . . Darwin”

Herbert Spencer, IIRC.

It depends on what you consider a ‘benefit.’ The upper classes are most likely to invest their extra wealth in productive capacity, philanthropic efforts and intellectual research. The lower classes will more likely eat an extra Big Mac, buy some Chinese-made products at WalMart, or perhaps add another mouth to their nursery. Tell me which of those two scenarios leads to a wealthier country in the long run?

We could add several hundred billion to our national income–more than enough to pay for Obama’s mob healthcare initiative–if we just balance the trade deficit…

A lot of those votes are based on the fact that the Republicans never intended to cut those programs in the first place. So the conservative-leaning voter can have the cake of being anti-government while taking all the benefits they can get. It’s hypocritical and irrational, and we’ll likely pay consequences as a society down the road, but many of the pols and some of the voters will be gone by the time it comes to pass.

The rich get richer because the rest of us, and the government, are giving our money to them. Instead of saving and investing in our own businesses (to compete with theirs), we just lease a new car or renovate our houses to pretend like we’ve made it. Then we tolerate the highest tax rates on the upper middle class–say the 80-98th percentile of incomes–who are right at the point where they could both live comfortably and afford to meaningfully invest (if the gov’t didn’t take it away).

The 50,000 page tax code has a ton of loopholes if you can afford $50k for an accountant and tax lawyer. Now we want to add more government programs, which will most likely put more money in the hands of the richest .5% (who own health care companies, military-industrialists, and ‘logistics’ outfits). The solution is to simplify, move to a consumption tax (like the FAIR tax) that allows people to accumulate tax-free savings, and shrink the federal government that does much more for the wealthiest than it ever has for the poorest.

Lastly, is it mere coincidence that the decline of US hegemony coincided with the rapid expansion of our entitlement programs and the end of our eugenic approach to immigration and family planning?

” the end of our eugenic approach to immigration and family planning?”

could you explain?

The Economist’s blog reported on a recent paper that seems relevant to your point here about housing wealth vs. wealth from other investments.

http://www.economist.com/blogs/freeexchange/2009/08/the_housing_wealth_effect.cfm

The upshot: housing wealth effects are statistically insignificant; investment wealth effects are statistically significant. Possible that investment wealth translates more readily into consumption, which reinforces status, strengthens the perception of inequality to go along with its appearance in statistics.

Actually, not so badly for those who stayed in hard cash or gold… For those who had money, life in the depression was exceptionally luxurious and very cheap.

There just weren’t that many of them – many people were highly leveraged, or margined, in the stock market. Many had assets in failed banks.

The key, for those who stayed in cash, was to spend a smaller percentage of their wealth than the rate of deflation. And this was easier for the wealthy than the poor.

What happens if instead of engaging in those things they buy Japanese or German cars (lexus? infiniti? bmw?), Swiss watches (rolex?), time-shares in foreign resorts, offshore bank accounts, large yachts flying the panamanian flag, second/third/fourth/fifth/sixth homes (chateaux in france? london? tuscany?), investments in Chinese real estate, foreign currency, hedge fund investments, helicopters and aircraft from airbus, exclusive club memberships, assorted global stocks and bonds, small islands, artwork and sculpture from international dealers, antique rugs from persia, etc…

Then what?

Hegemony and eugenics forever! eh pacer?

hey!!!

Andrew Somebody the last guy who became prominent because he honestly as his contract says earned a 100 million Dollars bonus owns a castle in Germany – therefore I want that country to be included in your list

– especially since Northern Germany where the castle is needs tourism urgently though Andrew ??? has first to be shamed in turning it from a private into a public museum.

I don’t mind Hegemony that has always existed albeit in multiple disguises – I wonder about what he means by eugenics and family planning – is he dreaming of Napolas? http://en.wikipedia.org/wiki/National_Political_Institutes_of_Education

to the best of my knowledge they were encouraged to breed to enhance the quality of the stock

For those interested, Studs Turkel interviewed some rich people during the Depression. The gist of the interview I heard was “we had to keep a low profile so we weren’t lynched.”

You can hear part of the interview on an episode of “This American Life.”

http://www.thisamericanlife.org/Radio_Episode.aspx?sched=1269

Ask the Argentines how that turned out…

http://www.ft.com/cms/s/2/778193e4-44d8-11de-82d6-00144feabdc0.html

Interesting paper (read the PDF link), a couple weaknesses:

– It’s the EU, not the US. Generally speaking, the EU wasn’t quite as profligate as the US.

– Measuring housing wealth is noiser than measuring cash/stock assets, and therefore subject to EIV (errors in variables) and the iron law (tends to attenuate estimates).

– The paper attempts to measure the impact of UNREALIZED housing (i.e. “paper”) wealth. However, during our boom, MUCH of that “paper” wealth was converted to currency wealth (by selling), which was funded by large mortgages (leaving other people impaired, and the banks holding lousy assets).

– They use a 1 year lag, but it’s quire possible that’s not the appropriate lag. Again, cash/stocks are more liquid and the recognition of that wealth potentially more immediate than paper housing wealth. This also does not account for the phenomenon of housing wealth being used as a backstop to cover excessive consumer loan indebtedness (via consolidation HELOCs).

The paper makes a point, but I would not dismiss the housing wealth argument in the US so quickly…

Actually, another point has to do with identification. Not only is paper housing wealth harder to measure, it’s also less variable year on year (for most years). The stock market fluctuates much more dramatically, which yields more leverage with which to estimate the parameter.

For housing wealth, it might be more appropriate to include the 3 or 5 year change…

Have you checked this data? If you look at the chart, you see that the middle class debt is only 25% of their assets. My first reaction is that is not a very large amount of debt at all. When you buy a first house, you put 20% or less down, and that usually absorbs all your assets. At 20% down, 80 % loan, you immediately have a debt/asset ration of .8. (Your debt is the 80% loan, your only asset is the house ) At 10% down, that ratio becomes 0.9. This is assuming all your wealth went into the down payment and the house price is really its worth, or asset value. The middle class looks to be in good shape at a debt/asset value of 0.25.

The other segments are in even better shape. Either the data is wrong, or we are all in better shape than we thought!

I think the middle class was and will be impoverished by labor arbitrage due to globalization. Bargaining power is shifted from labor to capital due to the increased labor supply from Asia and Eastern Europe. This was only covered up by the credit expansion but has been visible in places that did not participate in the credit bubble for years. Real incomes in Germany and Japan have been falling considerably in the last decade.

I don’t think this can be changed by wealth redistribution. We will have to wait until incomes globally have converged enough to make labor arbitrage (in the form of outsourcing, immigration or imported stuff) less profitable. In the meantime we should protect what is left of the manufacturing sector. Otherwise we end up as a colony of Asia.

Were the super wealthy ever really doing economically productive activities in excess of middle and lower class peoples? I am skeptical. I think that’s a lovely myth paid for by the super wealthy and exceptional pompous. Thousands and thousands of middle and lower class people make many small donations practically daily. They are at least as caring. Wealth ownership does not prove superiority of morality in any manner. Homage to wealth merely proves the social prison that we live in.

typo (change “seperate” to “separate”) about 3/4 of the way through the post:

“I bring it up because, in a separate analysis of similar data, Zero Hedge made similar points”

loved your response