For a complete list of Beginners articles, see Financial Crisis for Beginners.

My post about French sociology got a wide range of comments, ranging from “Without a doubt, your best post yet” to “Reading this post made me think, for the first time, of ignoring Baseline Scenario from now on,” which I guess indicates we have a wide range of readers. In any case, for today I’m returning to something much more mundane: GDP growth rates. Like many Beginners articles, this one starts out with some basics, and then gets (a little) more interesting, but its main goal is to help you decipher the news that you already read.

To a casual reader, yesterday’s GDP announcement was that Gross Domestic Product (an aggregate measure of economic activity) fell by 6.1% or, more precisely, at an annual rate of 6.1%. What does this mean?

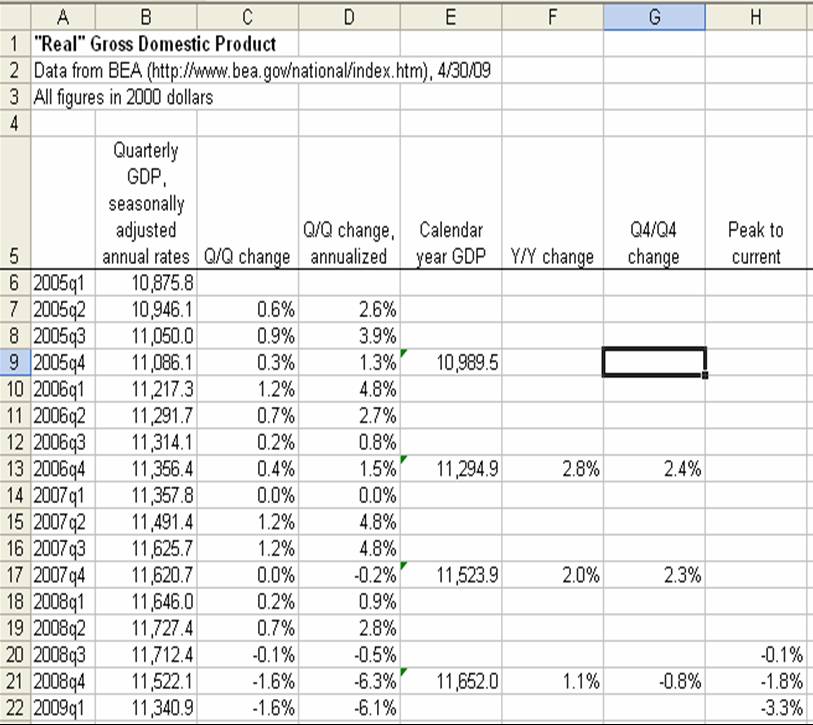

For those of you who have never visited the BEA website, this is what the raw numbers look like. (They give you columns B and E, I calculated the rest.) Note that this is all in 2000 dollars, so inflation has been taken out.

The columns are as follows:

- B: Quarterly GDP, or economic activity in that quarter. However, these numbers are expressed as seasonally adjusted annual rates. That is, GDP in 2009Q1 was not $11.3 trillion, but closer to 1/4 of that number, or about $2.8 trillion. The BEA multiplies by four, and also applies seasonal adjustments, like correcting for the fact that different quarters have different numbers of days.

- C: The change from the last quarter. So GDP in 2009Q1 was 1.6% less than in 2008Q4.

- D: The change from the last quarter, annualized; put another way, the total change you would get if that rate held constant for a full year; or, roughly column C times 4. This is the headline number you see in the newspapers. But the economy has not actually contracted by 6.1%. Skip ahead to column . . .

- H: This is the total change in economic activity since the most recent peak. In our case, the last peak was 2008Q2, when annualized GDP reached $11.727 trillion. So far, the economy has contracted by 3.3% – which is already a large amount. Head back to column . . .

- E: This is GDP for the full calendar year. Since column B was already annualized, you don’t add up the four quarters for each year; instead, you average them. The confusing thing is that there are two different ways of measuring changes in GDP from year to year, shown in columns F and G.

- F: This is the simple percentage change in column E. So total economic activity in 2008 was 1.1% greater than in 2007.

- G: This is the change from Q4 of one year to Q4 of the next year. This shows you how much GDP grew or contracted during the second year. So the economy in Q42008 was 0.8% smaller than in Q42007, meaning it contracted in 2008 – even though overall there was 1.1% more economic activity in 2008 than in 2007.

GDP also, by definition, has four components: personal consumption expenditures; private domestic investment (investment by companies and households in big things, like factories or houses); net exports (exports minus imports); and government spending. You will also see growth rates (like above) for each of these components, and for their sub-components. You can see all the tables in the BEA’s nice news release. For example, in Q1 personal consumption grew at an annual rate of 2.2%, which was the “good” news, but private domestic investment fell at an annual rate of 51.8%, which was the “bad” news. (That 51.8% includes a preliminary wild guess at inventory changes – adding stuff to inventory counts as GDP, taking stuff out of inventory counts as negative GDP – but even excluding inventories, fixed investment fell at a 37.9% rate.) The aggregate GDP growth rates are just the weighted averages of the growth rates of the components.

Yesterday’s announcement was at the low (bad) end of most forecasts. The first thing to bear in mind, though, is that this is just the advance estimate. While advance estimates under ordinary circumstances are not that bad, the advance estimate for Q4 was way off. All of these numbers are estimates, and when the world changes, the estimating models become less accurate.

In some cases, a steep fall might mean that the recovery will just come that much sooner – if the floor is somehow independently determined. This could be the case with housing prices, for example, where there are reasons to believe that fundamentals will put a floor under prices, at least expressed as a percentage of average income. But the economy as a whole is a much more complex system, so I doubt you can take the level of the floor as given.

The principles above apply generally to the rates of change you see in the newspaper: you’ll see period-to-period changes, which may or may not be annualized, and year-to-year changes, which may compare entire years or a single period with the period one year before. But there are differences in presentation that can be confusing.

For example, the Consumer Price Index (technically, the CPI-U, which is the headline index) is reported on a monthly basis, and changes in the CPI are reported over three different periods:

- Change from the previous month, seasonally adjusted (to take into account the fact that people’s consumption mix changes over the year) but not annualized. This is the current short-term monthly inflation rate.

- Change from three months before, seasonally adjusted and annualized. This is the average annualized inflation rate over the last three months.

- Change from the same month the previous year; this figure is already annualized by construction.

If you look at the most recent CPI news release, you’ll see that these three numbers are -0.1% (change from February to March, not annualized), 2.2% (change from December to March, annualized), and -0.4% (change from March 2008 to March 2009). The 2.2% and -0.4% are comparable, because they are both annual rates, but they are not comparable to -0.1%, which is a monthly rate. And is inflation positive or negative? It depends on which number you look at.

(Of course, the figure that the Fed and many economists focus on is CPI with food and energy stripped out. For that measure, the three numbers are 0.2%, 2.2%, and 1.8%, which are much more in line with each other; remember, the first one is monthly and the others are annual.)

When you see housing price changes, like changes in the Case-Shiller index, you usually see changes from the previous month or changes from the same month a year before; which one you focus on can have a major impact on how you interpret the numbers.

You need to be especially careful when interpreting economic indicator indexes. These do not show the absolute level of some economic phenomenon, but they are constructed to reflect the degree of change in some economic phenomenon. As a result, the index is already the “first derivative” of the economic phenomenon, so changes in the index are the “second derivative.”

For example, Calculated Risk today reported that the Restaurant Performance Index increased by 0.2% to 97.7 from February to March. However, as CR points out, “Any reading below 100 shows contraction. So the improvement in the index to 97.7 means the business is still contracting, but contracting at a slower pace.” In other words, activity was lower in March than in February. Is the increase in the index good news? Well, it’s better than a decline, and it’s better than staying the same. But indexes like this should have some degree of built-in reversion to the mean (around 100); things just can’t keep falling at a linear rate forever.

Finally, the Consumer Confidence Index of the Conference Board can be especially confusing. The index as a whole increased from 26.9 to 39.2 in April (the median over the last 20 years has been around 100, or a little below), driven largely by a jump in the Expectations Index (expectations about how the economy will be in six months) from 30.2 to 49.5. But the reading of 49.5, and the poll questions behind it, still indicate that many more people think the economy will get worse than think it will get better. So what we have is the economy getting worse, and even as it gets worse, most people think it will continue getting worse – but as time passes, a growing minority think that we are within six months of the bottom.

Hopefully that will help people interpret the numbers that make up so much of the economic news these days. As always, if you find mistakes, please let me know.

By James Kwak

James,

With respect to “H: This is the total change in economic activity since the most recent peak. In our case, the last peak was 2008Q2, when annualized GDP reached $11.727 trillion. So far, the economy has contracted by 3.3% – which is already a large amount.

On a per capita basis (which is rarely mentioned) with 0.9% population growth, this a about -4.2%. However, why is this large? From my perspective, I could cut my combined consumption and equipment purchases by that amount year-on-year and not suffer all that much. A company with a 4% drop in sales would also easily survive. (Contrast this to Cancun, Mexico, where occupancy rates are down to 20% from a normal 90%, or the auto industry.). The answer probably has to do with the fact that, instead of shorter hours or reduced pay, for many it is all or nothing. Is it worth elaborating?

Why aren’t more data presented as a graph of absolute values? If the line trends up or down there is a change. If the line is curved, the change is qickening or slowing. The essential interpretation is there and you don’t have to question whether its averaged or annualized.

Stat models may see correlations with different indices, but I’m not a stat model.

Rich

Maybe a stupid question. Why does the economists/governments spend so much time measuring a top-line number (e.g., expenditures, or revenue), instead of bottom-line numbers (e.g., income). Wouldn’t this be a better measurement of wealth creation?

Here’s where I think this is important: Consider imports/exports – does it really matter if we buy $50B worth of shoes and trinkets from China, and only sell them $30B worth of airplanes and PCs. Our net margin on the airplanes and PCs is 50%, we make $15B. Their net margin is 10%, they make $5B. Now consider they are continuing to sell us more trinkets at a growth rate of 10%, and our growth rate is 8%. From a GDP perspective this looks terrible, but overall, for us this beneficial for the short- to medium-term.

Am I out to lunch here?

That’s exactly the case, it is all or nothing. You either have a job or you get laid off. If you have a job, sure you could cut your expendatures by 4% – but if you’re laid off you have to cut your expendatures by 20, 40 or 60% – which you are unlikely to actually be able to do.

For companies it’s the same thing. Certainly Microsoft has huge profit margins and a cut in sales by a small amount doesn’t affect them long-term, but for many companies their profit margins are less than 4% – and while other’s may be higher their sales may be off even more simply because of their industry – whether sales are finance dependent, or it’s a luxury item etc. At the same time the Walmart’s, McDonald’s, etc. of the world are seeing sales pick up which also skews the figures of those with diminished sales. Also don’t forget that the banks are reporting profits, which reflects in the GDP numbers regardless of underlying potential insolvency.

In some ways this is how recessions end, inventories dry up, new products are ordered and there are less vendors to provide them so those that are left can get back to their pre-recession sales figures even before the product consumption reaches pre-recession levels. At least that’s what I tell myself so I can get to sleep at night.

“As always, if you find mistakes, please let me know.”

Quite a few mistakes, I will you 2 and post about the rest time permitting.

“B..The BEA multiplies by four…”

No, B.E.A. uses compound growth rates.

“B..applies seasonal adjustments, like correcting for the fact that different quarters have different numbers of days.”

That’s not quite the definition of seasonal adjustments, here it is:

Seasonal adjustment removes from the time series the average effect of variations that normally occur at about the same time and in about the same magnitude each year—for example, the effect of weather or holidays. After seasonal adjustment, trends, business cycles and other movements in the time series stand out more clearly.

One thing that’s particularly critical to remember when looking at “big” numbers like GDP is the difference between total and per-capita data.

If GDP falls 3% over the course of the year, and the population grows at 1%, that’s roughly a 4% decline in per capita GDP.

Real improvement requires that GDP grows faster than population – usually substantially faster, since as population grows this reduces each individual person’s share of the country’s natural resource endowment.

Thanks.

On the first point, I still think I am correct. I was not talking about the conversion of quarterly to annual growth rates; I was talking about the conversion of quarterly GDP to “annual rate” GDP. If GDP is Q1 was $100, then the “annual rate” GDP is $400, before applying seasonal adjustments. There is no growth rate to compound when you are talking about one quarter.

On the second point, thanks for the full definition. But variations in business days are also part of seasonal adjustments. Otherwise Q1 would always be slightly depressed relative to Q4. You also see seasonal adjustments in monthly numbers when holidays float between March and April.

Are population growth rates for a sigle year measured or forecast? If the latter, the per capital decline may not be as bad as MD and SG presume, as immigration probably slowed.

Hey StatsGuy,

Read my post above. Along the same lines, in the past at least, Presidents would say that we have more Americans working than at any time in history and no one would call them on it.

Maybe you have thoughts on the following. My income may be flat, but when I see unemployment start to rise, I cut back on my spending and the recession worsens. However, recessions are said to end before unemployment peaks. What causes that? One possible cause is that the stock market rises and I assume that the recession will soon be over, so I resume spending. Currently in vogue is the focus on second derivatives. Here this would mean that unemployment is rising, but at an ever slower pace. Is that what people are waiting for?

Thanks James, What consideration is factored in for inflation and money supply? I assume there is an outlook set of number? If we produce another set of negative numbers for Q2, what will this mean re health of our economy? What does this tell us re smart action options on our behalf?

On the first point, of course, you are right, as you were talking about the $ amount, not % change.

On the second point, day-count matters very little in seasonal adjustment. For ex. in the North East, more heating oil is consumed in january than in july, even though the day count is the same, and the “GDP estimates are seasonally adjusted at the detailed-series level when the series demonstrate statistically significant seasonal patterns” as is the case for heating oil consumption and many other series.

You state:

“Note that this is all in 2000 dollars, so inflation has been taken out.”

An odd way of stating that the GDP numbers are adjusted for inflation. How are we to interpret the GDP numbers when we know they are adjusted by an intentionally falsified CPI-U?

All this talk about GDP data is interesting, but where is some commentary on the Chrysler bankruptcy and government financing of a takeover of a major U.S. manufacturerthat contributes to GDP? Mr. Obama reminds us that we put men on the moon, so we can solve any problem if we work together. He’s right, but we didn’t need to bring in foreign leadership to do it. A merger with GM as part of that downsizing would have been a much better investment of taxpayer dollars in the auto industry.

I’m not an economist, so someone could maybe explain this to me. Are they adjusted by CPI-U or are they adjusted by the deflator? The deflator is way up somewhere close to 3%, as against headline deflation – ironically the GDP numbers would probably look really good if they were adjusted for deflation instead!

I don’t even pretend to understand the business cycle predictors – it’s all tea leaves to me. But you are quite right about self-serving manipulation of statistics by public officials – and the media.

“More people unemployed than ever in the history of the US” makes a great headline, until you consider that there are 50% more people in the US than in 1982.

The BEA does not use CPI to deflate GDP; BEA does some silly things, but using CPI (which measures consumer prices) to deflate GDP (which includes far more than just consumer products) would be really really silly. You can read the appendix to chapter 4 of the BEA publication “Concepts and Methods of the U.S. National Income and Product Accounts” to see how BEA deals with prices. It’s online.

knowing a GDP number is important but analyzing the components is also important.

Wow again. It feels good to have my earlier comment acknowledged and even cited. Thanks, Mr. Kwak. For better or worse, my loyalty to this blog has just increased.

A small correction to a very useful post: column B, as I understand it, does not contain “rates” but output measured in constant dollars. If I am right, you would need to change the heading of that column in the spreadsheet and the part of your explanation where you say “B: Quarterly GDP, or economic activity in that quarter. However, these numbers are expressed as seasonally adjusted annual RATES.” (My capitals.)

Except there’s no synergy between GM and Chrysler, and hence no impetus to merge. Both based their business models (such as they are) on high profit trucks and SUVs, and both failed to make a profitable biz off of small, fuel efficient cars. So there would be no benefit to a merger. For all one might say about Fiat, they do have a viable small-car business, and they presumably want to re-enter the US market. So they were willing to come to the table, unlike probably any other company.

Dave:

Thanks much for your comment.In my view, the disadvantages of a Chrysler takeover by a foreign a company like Fiat is that we need to maintain s strong position in our own market. Yes, there will be downsizing, but there are good vehicles at both Chrysler and GM, and they can build smaller, more fuel efficient vehicles just as Ford is doing. It is not a “victory” for us to establish another foreign “transplant” here and do it by turning over

the factories, dealers, etc. while supplying all of the initial $8 billion of funding. If Fiat has such good cars for our market, why haven’t they don’t well here on their own.The Chrysler/Fiat deal is very bad

“industrial policy”.

Ken Davis

Ken,

I reckon that if they merged Chrysler and GM there would need to be more layoffs (due to model and or brand cancellation) as both make a similar range of cars – this owuld have follow on effects to auto suppliers

It would also take a number of years to bring smaller more fuel efficient cars to the market so it wouldn’t just be a matter of shifting workers from making big cars to small cars.

Fiat bring the technology to make these smaller efficient cars, and their management have also successfully turned Fiat around (whihc was dying a painful death).

Hi Ted

GDP does take this into account. It measures “value added”, so if someone sells you $30m of raw materials and you sell manufactured products for $70m, your contribution to GDP is only $40m. The $30m has already been counted in the GDP contribution of your supplier (if they’re in the US, it’s in US figures, and if you bought them from China, it’s in the Chinese figures).

But in your example, you also need to think about where the “net margin” comes from. The Chinese may make a margin of $5B on their $50B of shoes, but where did the $45B of costs go? Most of it was probably spent within China, so it’s likely that there really is close to $50B worth of GDP generated. Similarly most of the $30B of airplanes is spent in the US. The profit margin of the final supplier doesn’t really matter, though it does affect the distribution of GDP between wages and profits – in your example, Chinese workers get nearly all of the Chinese returns while US investors get a high proportion of the returns compared to US workers.

You got to be kidding. The chinese workers get next to nothing. It is their communist masters who get the profits.

That may be so, I have no data either way. The point is that it’s still Chinese GDP. The division between profits and wages (or whatever the equivalent distinction is in China) is secondary.

Incidentally, even if workers in China do receive reasonable wages, there’s an argument that the high levels of Chinese private saving are just a disguised tax. I wonder whether the average Chinese citizen will get any kind of reasonable return on the 40-50% of their income that is saved on their behalf.