By James Kwak

One of Congress’s top priorities this week and next is to pass some kind of funding bill that will keep the federal government operating past December 11. There are basically two ways this could happen. Option A is that Congress could pass a continuing resolution that maintains funding at current levels until, say, the end of January—that is, when we’ll have a new Congress and a new administration. Option B is to pass an omnibus fiscal year 2021 spending bill that determines discretionary spending levels through September of next year when the federal government’s fiscal year ends.

The Democratic leadership apparently is pushing for Option B because—well, probably because they think it’s the responsible thing to do and will make them look good with that tiny but all-important segment of voters who know the difference between a continuing resolution and a proper appropriations bill. But, in doing so, they could be throwing away one of the few levers that Democrats will have to actually accomplish anything during the next congressional term.

The point is that government funding measures are must-pass bills. No one likes a government shutdown, and historically Democrats have been able to pin most of the blame for them on Republicans, dating back to 1995, when Bill Clinton successfully portrayed Newt Gingrich as a zealot who was out to slash Medicare (which he was). If Jon Ossoff and Raphael Warnock come through in Georgia on January 5, Democrats will have majorities in both houses of Congress for the first time since 2010—but such razor-thin minorities that Joe Manchin is already rubbing his hands with glee at the prospect of becoming the most important person on Capitol Hill.

In this context, an omnibus budget reconciliation bill could represent one of the Biden administration’s few real chances to pass anything through Congress. Bills passed through reconciliation are not subject to the Senate filibuster (which isn’t going away, regardless of what you think about it), which means they only need a bare majority. The need to avert a government shutdown creates the pressure to bring people (the so-called moderates) to the table to come to a deal. Now, Joe Manchin isn’t suddenly going to become a sponsor of the Green New Deal because the Democrats have a majority in the Senate—he’s going to extract everything he can in exchange for his vote. But there is still a lot that Democrats could accomplish in an omnibus spending bill: money for the DOJ Civil Rights Division, money for the EPA, money for election protection, money for low-income housing, and so on. This is an opportunity to dictate discretionary spending priorities a full eight months earlier than we would otherwise be able to do. And would you rather negotiate with Manchin or with Mitch McConnell?

And yet the Democratic leadership in Congress seems inclined to give up the potential chance to write their own appropriations bill in January in exchange for a bill that they have to negotiate with McConnell and . . . Donald J. Trump. (The vague new COVID-19 stimulus bill that people are talking about is currently being positioned as a separate piece of legislation—which makes sense because it’s toxic to most Republicans.) It’s almost as if they don’t want the opportunity to govern. Sure, Ossoff and Warnock could lose in January, but we would still be in a stronger position than we are now, with Biden in the White House.

During the next two years, we are going to have precious few chances to pass any kind of meaningful legislation. Why are we throwing one of them away?

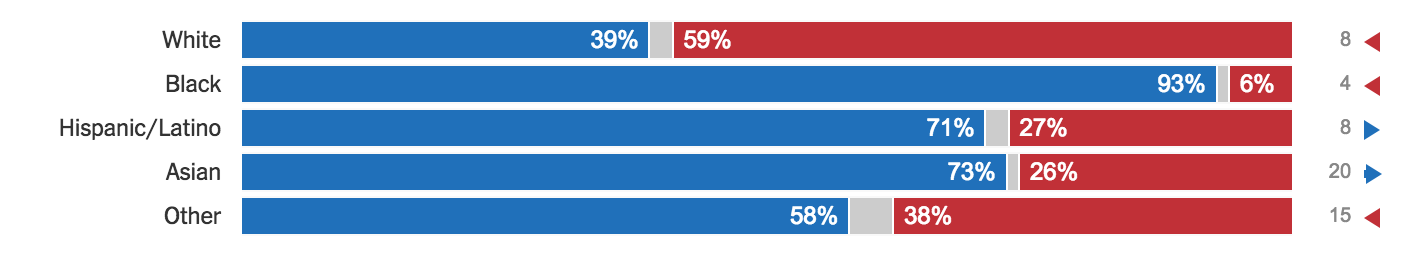

The respective roles of race and class in this year’s election are a highly contentious issue. I’d like to add to that contentiousness as little as possible while pointing out that this race-based framing isn’t really supported by exit poll data. I want to get ahead of the vitriol by stipulating that the exit polls don’t provide conclusive evidence for either side.

The respective roles of race and class in this year’s election are a highly contentious issue. I’d like to add to that contentiousness as little as possible while pointing out that this race-based framing isn’t really supported by exit poll data. I want to get ahead of the vitriol by stipulating that the exit polls don’t provide conclusive evidence for either side.