There has been a fair amount of hand-wringing along Sand Hill Road in Menlo Park over the lack of “exits” – IPOs and acquisitions – for venture-backed technology companies. Given the way the stock market has behaved recently, it’s pretty near impossible for a young technology company to go public. And the large technology companies that do most of the acquiring have been unusually quiet, presumably because they are watching their cash and avoiding risks given the global economic downturn.

However, there’s one major reason why large technology companies should be buying:

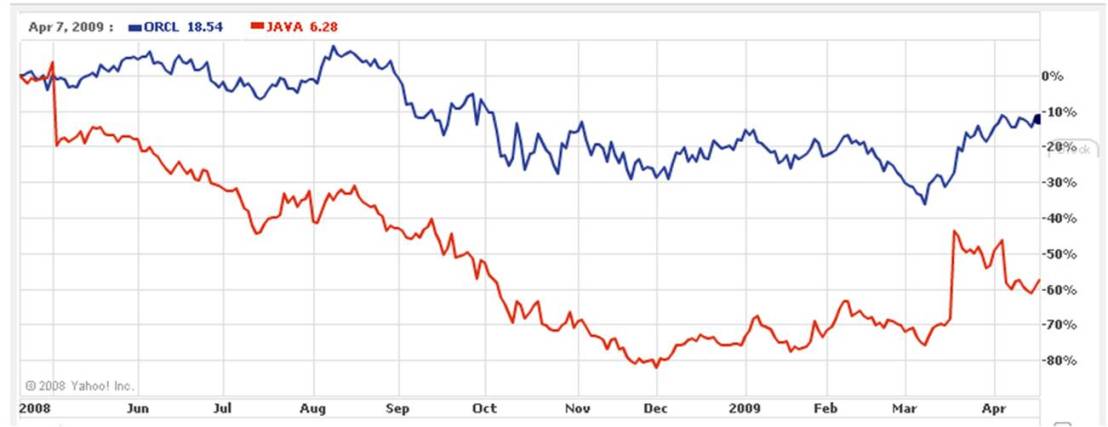

Blue is the share price of Oracle; red is the price of Sun (the spike in March is Sun’s merger negotiations with IBM). At some point, prices fall to the point where people start buying again. While the recession has hurt almost every company, it disproportionately hurts companies that do not have fat profit margins, hordes of repeat customers, and deep cash reserves that they can rely on in hard times. The result is huge changes in the relative values of companies, creating some once-in-a-generation bargains.

I don’t think the Oracle-Sun acquisition is a sign of a bottom or anything dramatic like that. But it shows that at least some companies are doing what they should be doing.

By James Kwak