Most of the provisions of the Credit CARD Act of 2009 go into effect on February 22. Card issuers are adapting in various ways. I’ve previously written about the 79.9% APR (used to get around the limit on up-front fees for subprime cards). Now one of our readers has written in about an even more clever gimmick.

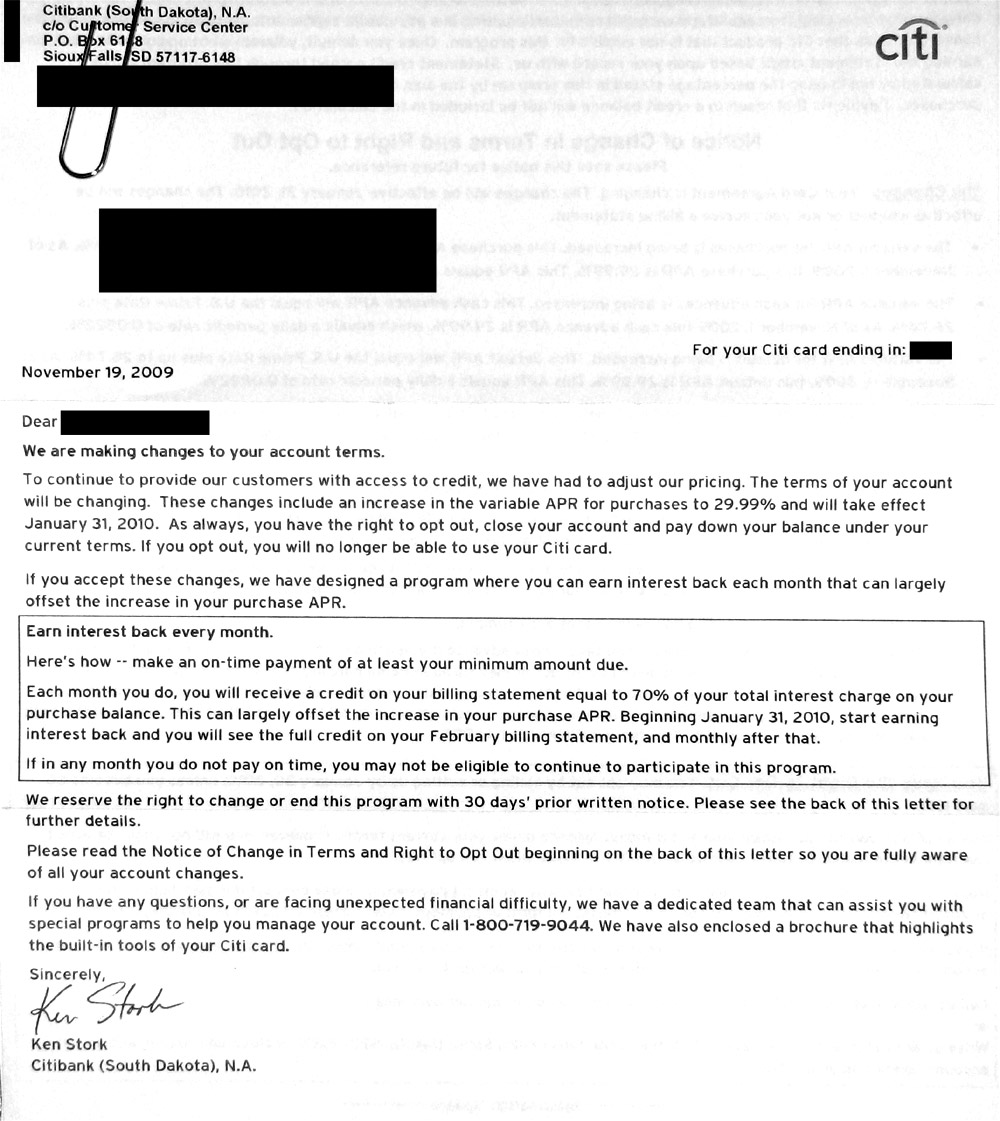

Here’s the letter:

Section 171 of the CARD Act (detailed guide here) prohibits “hair-trigger” increases in credit card interest rates on outstanding balances, whereby an issuer could increase a rate for any reason at any time. 171(b) specifies how interest rates can be changed; for example, the rate can change as the index it is based on changes, or the rate can change at the end of a clearly defined introductory period. 171(b)(4) says that if a borrower misses a minimum payment, the issuer has to wait sixty days before raising the interest rate. 171(b)(4)(B) says that after raising the rate, if the borrower makes the minimum payments for the next six months, the issuer has to restore the previous rate.

The person who got the letter above used to have an 8.1% APR. This letter raises the APR to 29.99%. But, if he pays his balance on time, he will get a “credit” amounting to (at least) 70% of the interest amount, bringing the APR down to 8.99%. If he misses a minimum payment, he may not be eligible to continue in the program. In other words, he has an 8.99% APR that jumps to 29.99% immediately (retroactively, actually, since it can apply to the previous month’s balance) if he misses a payment. Furthermore, the 8.99% rate does not have to be restored after six months of making payments, because the official rate was always 29.99%, and the 70% credit is just a “program.”

This attempt to get around Congress’s clear legislative intent is so transparent that it should be an easy case for the appropriate regulator to strike down. I believe the appropriate regulator for this kind of thing is the Federal Reserve. Maybe Ben Bernanke can show that he’s serious about consumer protection.

By James Kwak

I do wish you’d included the back of the letter; where the legal language is spelled out.

As I’ve said before … in Canada it is a Criminal Code offence to sell “financial products” with annual interest and fees combined that exceed 60%.

On another bizzare note … Google adsense seems to have targeted my blog for a payday loan advertisement. Maybe a “robot” program concluded a co-relation, since I have commented about payday loans before at baseline scenario.

A bit of marketing “pollution” that thankfully I have the control to remove.

On another note …

What kind of economic policy is underway when in North America manufacturing has been largely outsourced and now IT and accounting jobs are being outsourced.

What next? I mean what are people going to do for a living?

Shocking to learn that 70% of the American economy is based on consumer spending. Where are people going to find the money to service their debt let alone pay it off?

Please … no ad hominem attacks but a serious discussion on macroeconomic policy.

I wonder what Joseph Stiglitz would say.

My guess is that’s it’s pretty much all over but the shouting. The only reasonable solution is to just throw the damned cards away.

Exactly. Ya know, sharia law — no interest — is looking pretty good right now, at least as far as finance goes.

Technically I think the “appropriate regulator” for Citibank South Dakota, N.A., is the OCC. The Fed creates the implementing rules and national bank compliance resides with their primary regulator.

Why shouldn’t credit cards be able to do pretty much whatever they want with interest rates on UNSECURED debt? I mean, this letter is basically just an example of Citi jumping up and down like a two year old throwing a fit, but a two year old doesn’t have the final say, and neither does Citi. Their debtor can decide at any moment not to pay the bills (and their models for who will and who won’t default are pretty much garbage at this point). That debtor will have to ignore one gazillion calls from collection agencies and get by for a few years with a badly damaged credit rating, but eventually the statute of limitations makes it all disappear (in only three years in some states). Citi doesn’t hold a single card in that scenario. Not to mention all of the profits they’re trying to protect…they are a publicly traded company after all. I just don’t get the “I’m shocked, shocked” attitude that this blog always displays.

Bastards. Bastard coated bastards with bastard filling. I cannot hate the banking industry enough.

I’m not sure if I’m shocked or not. It’s rather amazing how they simply give the finger to every single attempt to make them behave like civilized citizens of society. Psychopathy taken to a level I honestly never thought possible of humans. Complete and utter contempt for other human beings.

Perhaps I’m not shocked as much as I’m in awe of how petty and worthless these people are.

This kind of thing is going to lead to debtor’s revolt, and it should. I have no debt of any kind, but I would advise anyone who got a letter like this to default. In theory, they could sue and garnish your wages. But as long as the tab is less than 5K, there simply won’t be enough attorneys or courts to handle the number of delinquency actions that result from this kind of garbage. Repugnant.

“What kind of economic policy is underway when in North America manufacturing has been largely outsourced and now IT and accounting jobs are being outsourced. What next? I mean what are people going to do for a living?”

I’ve been running around asking this question since my teenage days.

I’ve yet to hear a good answer.

Sad to say, America might just be entering the real world where “stuff” happens and nothing can be done.

People will not be able to pay and society will have become poor.

But 10 to 15% of China and India has become very rich, totalling a richer and larger consumer market.

“Merchants have no allegiance to country”. I think that was said by one of the founding fathers.

I’m a master level engineer. I had to read that three times to figure out the implications and the tiered rules that would apply……

THAT is the issue, not that they can’t structure rates anyway they (credit companies) want.

Credit Union Credit cards are capped by law at 18%…looks like a great option about right now for anyone who still has a TBTF credit card…..

Does anyone else out there share my concern for the vast swaths of the American economy that are now based on the business model of doing nothing, but possessing license to extract fees and leveraging such license to increasingly astronomically insane levels? In fact, looking only at the financial services and health insurance industries, the majority of the American economy is now based on this entirely parasitic, non-value added business model.

What do you do? We design, architect, manufacture, make, warehouse, distribute, sell, or service nothing tangible. We entirely specialize in extracting fees, transaction charges, facilitation payments, intermediary cuts, and the like….and we employ millions of people in all states who do nothing but extract fees based on our license to do so, and, who in their spare time invent new and innovative ones….

Unsustainable business model anyone? We credit deposits late, clear large checks first and ASAP to increase our chance to impose the largest amount of large fees that have no basis in, or relation to the service provided, or possess even a tether to legitimacy…We even have fees to provide statements and even to pay us our own bill…

I’ve had fun with this one. Idea for anyone who owns a business-when a TBTF employee comes in to pick up something/anything at your business and wants to pay….hand them an invoice with these charges added to it:

Document prep fee $32.00

Statement fee $19.00

Transaction fee $15.00

Same day pick up fee $25.00

And…hand it to the TBTF executive with a straight face. When they ask about and dispute the charges, indignantly respond “well you asked me to prepare your statement ($32)…then you required me to print your statement for your review ($19)…then you wanted to pay me ($15)…and, finally, you require to have your payment expedited to allow you to take your car today-same day ($25)…is there a problem….? The expression on the Wells Fargo executive’s face I did this to was priceless….

Needless to say, I ultimately waived all these charges. My business does not possess a license to extract fees, and there may have been legal issues. But, I made my point….

Actually, Tippy, that is a good and serious question. It has been answered so far by “experts” and opinionators in the form of unrealistic speculations (“the green economy”; “the knowledge economy”; some form of redemptive technology). I’ve yet to be persuaded that any of these salvations would help any but a small percentage of America’s working population. In a winner-take-all system like ours, the likelihood is great that any new economy would help only those who are benefitting disproportionately from the current economy.

One of the curious results of a widely held convention like the belief in limitless growth is an inability to follow the trajectory of these ideas. We are probably at the fallout proint in the trajectory of the limitless-growth-on-a-finite-planet idea. Not to mention the idea of superconcentration of social wealth in ever fewer private hands. And we find ourselves in liquidation nation. And even that has only short-term prospects.

There is good cause to be concerned when everyone seems to think we’ll have recovered when a large number of the working middle class is back to borrowing its income to keep the economy going.

Had a card that tried to jack up my interest rates similar to this in 2007 for no reason but greed. I found another with a low, fixed rate first then cancelled the offensive one. They spent the next year trying to woo me back. But the rat was smelled and since then, I pay my card off every month and do alot more cash transactions. No interest on cash. If everyone did the same, these credit card banks would go out of business.

Nicely put, Darrell. But my understanding of capitalism is that at some point, every business tends toward financialization. That is, every profit-oriented business wants to get into the business of collecting “rents” (fees, and especially interest) and out of the business of producing things. The profit margins have to be considerably higher if you’re not actually producing, only extracting fees on a saleable idea or pass-through service. Wasn’t General Motors doing much better as a finance company than as a carmaker?

In this light, outsourcing is worth a second look. The ultimate goal of outsourcing isn’t to reduce production costs: it’s to minimize ownership of the apparatus of production. The perfect solution is to slough off ownership costs of the business onto the public, in the form of the state, while maintaining exclusive private control over rents and fees. Perhaps that’s what really makes China so desirable a business location for American businesses: the Chinese state is the ultimate owner of the production apparatus and its costs. The U.S. company, whatever its line of business, becomes a pure play: licensing ideas and collecting fees. I think that’s considered an elegant equation in business schools.

I really hate to side with the banks here, but since when is unsecured credit a right? Let the market (people) decide what a fair credit card deal is and let the government stay out of it. If I make a loan to someone who I think has only a 50% chance of repaying, I should be able to collect 51% interest.

The only aspect of this credit card legislation that makes any sense is forcing simple plans. There should never be a cap on any interest rate as long as that rate is clearly displayed. The End. Credit cards are a competitive market. If every company were simply required to set their fees along the same structure, smart people would get good deals, and stupid and/or lazy people would get fleeced.

As my grandfather always said, A fool and their money are soon parted. Wouldn’t you rather be the one to take it from them?

This is a problem for us as well as the UK, Spain, Australia, and a number of other industrialized countries.

China handles it by polluting the world, paying their workers lower wages than the rest of the world, and undervaluing their currency.

Germany and Japan handle it by making quality durable goods that it sells to the world.

Saudi Arabia, Kuwait, Qatar, the UAE, and the rest of the Middle East do it by selling oil to the world.

What do you do when all of the goods-producing jobs go overseas?

My answer: you transition to a services-based economy (as we’ve done with finance)

and/or

you think up new goods to start producing (as many Democrats are hoping for in a new green economy)

What we need is no-nonsense ursury laws, with penalties including prohibition to continue to offer credit cards, and a canonical contract for credit cards. I think we can all do without this kind of “innovation”, it is the most disgusting money grubbing imaginable, right of a kind with pay day loans and bail bonds. Waiting for Bernanke might be a good title for a play, but it is not a serious proposition for fixing actual problems.

“As my grandfather always said, A fool and their money are soon parted. Wouldn’t you rather be the one to take it from them?”

The money is not worth it. I propose your grandfather might have made an observation, not a recommendation. There is opportunity cost, and then there is the cost of opportunism, in any sense.

The guy who’s the father of the credit card in the U.S. was named Hock, according to Joe Norcera “A Piece of the Action.”Dee Ward Hock . Fitting name for a person who turned finance into loan sharking.

Manufacturing is so close to the U.S. shores with the incredibly cheap cost of shipping , thanks to box containers.You could almost think if it as ghosts producing stuff. Most of the stuff that comes from China is at one or two percent shipping. Most of it from U.S. companies with plants in China.Post patriotic production of corporations.

One thing that th epress has not made clear – The CARD Act shifted credit costs from those that misuse the product to those that do not. Citi’s program is a crafty (not sure it is legal, but a different question), attempt to provide a break to the cardholder that does not misuse the product. You pay your minimum balance on time, you get a rate under 9% – you don’t, you pay a 29.99% rate. Otherwise, I guess they could raise eveyone’s rate to 21% and not offer the good credits the break . . .

Actually, the fine print says that you can cancel the card and retain use until it expires (in my case, in 18 months) with the original contract terms unchanged. Plenty of time for other offers to come in the mail and a switch to be made.

I think the issue that was illustrated here was that the person who received the letter had a good rate which was jacked up to an unreasonable rate.

It happened to me as well, with no provocation. I pay on time, every month and have not given banks any reason to assume a low chance of repayment. If anything, I’m a better risk now that credit card companies have so kindly lowered my limits on other cards I hold.

Most people make financial plans based on what their interest payments currently are. When banks increase the rate by over 20% in an unprecedented money grab, it’s not reasonable to blame the person with the debt.

I never had a problem with errant fees until recently. I think the credit card companies might be hurting for revenue…

I just had to fight with a credit card company over a card which I had paid off. I received two surprise charges at the end of the billing period: a finance charge of $15.52 and a payment protection (a since canceled SCAM) charge of $0.13. Payment protection is only charged if you have an unpaid balance at the end of the billing period (which I did not). The regular customer service people said I received the finance charge because of the $.13 payment protection fee. The payment protection people said I was charged that because I had an outstanding balance of $15.52 at the end of the period. Ain’t circular logic grand? Both fees were subsequently waived, but only after I repeatedly point out that the only thing I owed was the sum of these two unwarranted fees.

Why do we need credit cards again?

Forgive me if this response includes an ad hominem attack. It is a while since I knew what that was. Let me suggest that the corporatist economic model works as follows: unlimited freedom for business to pursue profit and for corporate executives to steal it through ‘compensation plans’ stage managed by bought and paid for directors chosen with due regard for race and gender who are coopted because their ownly business is selling their director services (and who would choose any of them if he or she ever disagreed with the recommendations of the compensation consultants) who are chosen by management and whose recommendations are excused on the ground that every other company does exactly the same thing.

In this business environment, profits are generated by sweating labor, including the IT variety which is heavily overcompensated relative to Indian and Chinese colleagues, who conveniently speak the King’s English and eagerly work for peanuts.

What do the corporatists do about all these inconvenient Americans who inhabit the country and expect to buy things as their progenitors did? The answer is lend them money. Credit cards are the early 20th Century company store redux. No doubt there is an excellent reason why banks borrowing from the Fed at .01% must charge 29% on credit card loans in order to make ends meet. As for a career, the answer they will soon be selling (and may be selling already) is JOIN THE MILITARY and crusade against terrorism (of the rag head variety as opposed to the finanancial variety). Thus will the Go’mint avoid those financially inconvenient reinlistment bonuses and obtain sufficient fodder from the coming generation of job seekers, who will value three hots and a cot just as young men did during the late Thirties, as per From Here to Eternity, by James Jones (or Frank Sinatra for film afficionados).

Usury is the bastion of corporatism, credit cards a substitute for living wages. Perhaps Obama’s next crusade ought to be Usury Reform, in which he can take credit for driving down the rate to 25%, a rate which used to bring jail time in New York and was then enforced only by muscular citizens named Vito who generally asked which leg you preferred broken and then broke the other one.

As for a serious suggestion, why not simply put the Fed in the consumer lending business? It doesn’t require any particular savvy to conduct mass mailings to every person and pet in the country and sign each of them up for a small introductory credit line. The Fed could settle payments through its own web site and the postage savings would be tremendous. This would also end those degrading visigoth commercials for the bank whose name I can never recall.

It is high time consumer finance became a public function, like mail service. Yes, the govt will screw it up in improbable ways, but like Medicare it will work pretty well and cost a whole lot less than the private, robust, innovative version, which is nothing at bottom except robbery.

All the chatter about jobs moving offshore points up (again) the wisdom and foresight of our Founding Fathers. The original taxation scheme was to derive taxes from property and excises on imports. Of course, the multi-national corporations bribed our politicians at the federal level to reduce excises and institute the individual income tax as a replacement. I dare say if there was any kind of reasonable excise tax on just Chinese imports, we would have a balanced budget and the jobs would not be leaving our country!

Jake, that was fantastic.

The unpleasant answer is that in competeing with relatively low paid foreign workers, US workers will have to take lower wages themselves.

This can occur by US jobs moving overseas, and the workers moving on to usually lower paid jobs, or (preferably) by US workers accepting lower wages for the jobs they are doing.

If there are other solutions, I’d be glad to hear about them.

These banks are crooked.

If a person decides to stop using credit, then perhaps a possible step would be to wreck their own credit rating – burn the plastic bridge.

That could be done by running the card up to its limit, and then just stop paying.

Of course, bear in mind that credit reports are accessed by all sorts of people, like prospective employers, insureres etc.

Thomas Jefferson to John Taylor, 1816

“I sincerely believe … that banking establishments are more dangerous than standing armies, and that the principle of spending money to be paid by posterity under the name of funding is but swindling futurity on a large scale.”

http://www.fame.org/NotableQuotes.asp

tippygolden

February 2, 2010 at 11:07 am wrote:

“As I’ve said before … in Canada it is a Criminal Code offence to sell “financial products” with annual interest and fees combined that exceed 60%.

True, but the law does appear to be an impediment, to the selling of their “financial products” here. :-)

“but the law does appear to be an impediment to the selling of their “financial products” here. :-)

The return address on the sample envelope reminds me that upon Sen. Dodd’s retirement (and assuming continued Democratic control of the Senate), I think we can all safely expect that the Chairmanship of the Senate Banking Committee next Congress will fall to its second most senior Democrat. And for those keeping score at home, that would be South Dakota’s own Sen. Tim Johnson.

Good luck, consumer credit users everywhere.

Another suggestion or two: eliminate individual income tax on incomes below $250k; institute a graduated tax running from 45 to 90% on incomes above this level, replace corporate income tax with corporate franchise tax on dollar capitalization of public corporations; establish a 1% tax on all financial market transactions involving more than $200,000. These reforms will require business to at least pay for the government which it already owns; it will give helpless individuals badly needed wiggle room and allow them to forget politics since it offers them nothing in any case.

Citi is evil, evil, evil. Cut up any Citi cards you have and close your accounts NOW.

Evil. Pure evil.

Citibank and its confreres in the TBTF Society should be ashamed. But they’re not, and they are greedy to an extent rarely seen in human history. What used to be a convenience and a reliable service has turned into just one more way to game the consumer. And, yes, let’s see if Bernanke’s troups will call a halt to any such bogus practices. I hope that Citi is the next victim of terrorism, since that is what they have been visiting on their customers.

Excellent comment.

Scandalous, the corruption and fraud of usury is alive and well.

Interestingly enough, having majored in Finance and Accounting (BS) and Information Systems (Masters) the former Adam Smith model of comparative advantage is, quite simply, obsolete. So, to be very blunt, there is no answer to your question, that is, with the flip of a switch service industry jobs can be outsourced…it doesn’t take 20 years or millions (if not billions) if investment in capital as required by the manufacturing industry to outsource, effectively, over several decades.

Specifically, the concept of Hawaii growing pineapples and selling those to the US in exchange for us providing Financial Services is a red herring (at best) and a cataclysmic assumption for future economic policy as the comparative advantage where some level of purchasing power parity is reached via trade based on relative comparative advantages to production is completely shattered if not simply irrelevant in our Knowledge based economy.

So, free trade, and the the comparative advantage model was entirely based on a manufacturing economy where, again, one country produces shoes (because they have shoe trees that grow naturally there year round) and another produces cars as there’s ample iron, water, and associated (human) capital. Within this model, the infamous economic assumption whereby “all things being equal” there are also tremendous barriers to entry for that next country or economy to enter into either the shoe or car business where existing producers have intrinsic advantages in production whether based on natural resources or existing advances in capital and training of human resources.

In stark contrast, there are NO barriers to entry in our modern knowledge-based service economy. For example, to start the next Google (which China did, by the way) one simply needs a handful of laptops and some very smart, young minds especially in an open source world where the OS (operating system), programming language, and even the hardware, actually, have become extremely cheap to if not entirely free.

In this service-based economic model there are no comparative advantages or barriers to entry unless one assumes some country/continent inherently produces more computer geniuses or Engineering experts than another which we know is absurd. In fact, assuming the traditional bell curve India and China actually produce many more computer science, engineering, and financial geniuses in absolute numbers even if the statistical distribution is exactly the same.

Couple years ago “The Economist” had an article in which the UK was considering subsidizing manufacturing recognizing without those jobs their middle class was hopelessly being dismantled and there were no substitute jobs/industries. That seemed like one, small, potential answer which would be very agreeable to most (although 51% of Americans would probably vote against it while waiting in a soup line;)

Unfortunately, in the rat race for the most profits I think the United States – being the cowboys we’ve always been – strategically overlooked a very fundamental question: if we outsource middle class manufacturing jobs what is that substitute industry? Can all the factory workers become programmers, financial analysts, or, perhaps, reality TV stars;) Interestingly enough, when Silicon Valley shutdown several Aerospace firms they tried such an experiment back in the 80s: take former manufacturing types and teach them to program and it was an abysmal failure…isn’t talked about much and went down the memory hole but we actually had the answer even 30 years ago;)

So, to date, even “experts” at Harvard Business School are starting to re-examine the Adam Smith model of economics over the past 10 years and though it doesn’t get much press the fact is there is a very strong school of economists emerging who are now vocally stating the comparative advantage model of free trade is obsolete yet for all the research I have done there are still no answers even to the correct questions aside from creating “fake” jobs for the very sake of propping up a consumer-based economy and the “fake job” theory is a dissertation in and of itself.

In short, one can outsource any IT department tomorrow: need 400 laptops (assuming Fortune 500 company), ability to ssh (they don’t have to be in US to get to servers), and fundamental abilities to administrate database, operating system, and manager software development life cycle. Flip the switches and department is outsourced. NCR had already done this in Dayton, OH along with a host of other Fortune 500 organizations.

The only service sector jobs safe from outsourcing are tied to the Department of Defense and in this very strange, modern world it wouldn’t shock me if the DoD starts opening Secret and Top Secret clearances to Indian developers within the next 5 to 7 years: sounds far-fetched but as a contractor I’ve already seen something very close to this on the DoD side.

What next? I don’t think anyone knows the answer yet I think the short-term attempt will be to create lots and lots of “Green” jobs a large percentage of which will be created simply for the sake of propping up our Consumer based economy in the US. Otherwise, I’m not sure there is another industry and even those former “give tax credits to the large companies”…what does that encourage when that same company can take the local tax break and invest it directly in expanding their plant or even IT department in China. Heck, makes it very difficult to even leverage traditional fiscal/monetary policies to reinvigorate the US economy.

By the way, this is one of the most intelligent, insightful threads I have ever read in reaction to a very good, interesting article. And the lack of reactionary, emotional commentary is refreshing.

Everyone of the comments I have read are very thoughtful and some are darn insightful. Unfortunately, I think there is a consensus/conclusion to extract: service based economy rapidly drives wealth to few with no barriers to exporting to the next, cheaper country/economy to chase ever-higher profits.

There would have to be a moral or ethical or even patriotic motive to prevent this inevitable conclusion/trend (or somewhat harsh government policy). Otherwise, I don’t see the downside for the owners of capital/super rich.

We need to be aware of the merchants’ cost every time we use credit cards — these fees raise the ticket price of everything, of course, whether we pay by card or by cash, but when we use plastic it operates like a hidden tax sucking money out of our local area and channeling it to the bloated top. Some businesses, I hear, are offering discounts when we use cash to pay. Power to them. And no doubt the credit card companies are going to punish this practice however they can.

, , but then there’s peak oil looming on our horizon , ,

I think Lynn Tilton talking on Yahoo! Tech Ticker today (2/2) has the right idea. Effectively she is saying we need to produce and buy domestically, everything we can – and legislate whatever we can to make that happen.

http://finance.yahoo.com/tech-ticker/obama%27s-job-proposals-%22don%27t-get-to-the-core-of-the-issue%22-lynn-tilton-says-417280.html?tickers=MAN,GSPC,dji,TLT,TBT,UUP,XLI

Our saving grace may be peak oil – if energy costs rise to a point where transporting goods from afar becomes prohibitive, that will bolster local economies.

Yes — it occurred to me too. If enough of us did that, we could hit them where it hurts. Doubtless all the people who lost their houses ran their cards up to the limit first, and defaulted, not to speak of all the other people who lost their jobs, so the credit card companies are already hurting. And if someone in our family has a good card and lets us use it for a few years until our credit history expires and we can get into the game again, then we could just take a ride on the b-tards.

But then I realized that at any time it wants to, the government can pass really nasty laws punishing defaulters. Retroactive laws. Take-your-home-and diamond-ring-type laws like the IRS operates with now. Forced labor, debtors’ prison type laws. I mean, guess who’s calling the shots in the legislature now?

More or less my sentiments.

Instead of playing games with semantics, why doesn’t Citi just get out of the credit card business. Eventually, that is what is going to happen anyway – as people with good credit go elsewhere, the people with bad credit default, and/or Citi finally bites the proverbial dust like it should.

This may be a stupid question, but why do you need a credit card in the first place? Why just not save some money to act as a reserve and replenish it when it has been used? Use is just like with the credit card, except you are not paying interest.

I don’t think there is as much shock as just outrage and disgust.

Given what they are doing, isn’t it likely that people with good credit will either not use their cards or go elsewhere (like a credit union)? So Citi ends up preying on people locked into Citi’s high interest cards. Ethical? Then a huge chunk of those people default. Citi goes whining that they need more bailout money. Ethical? (Personally, I hope to hell they don’t get another nickel. But with Helicopter Ben and Timmy-the-tax-cheat doing their best to enable the financial terrorists, I’m guessing they’ll get help – overtly or covertly.)

Excellent comment. I think growing consciousness of being on a finite planet is a powerful factor in economic mess, one which is not being taken into account by the financiers and economists. They say recovery is based on the revival of “confidence” — but it is impossible to be confident in the old sense of riding economic cycles back into the next boom when we no longer believe in the game.

The main reason I keep a credit card is because if I travel, I cannot rent a car without one. Is there a way to rent a car without one?

Maybe a debit card?

Anyway good point, but I’m under the impression that credit cards are mostly used for other things where it might not be necessary.

What’s wrong with 70% of the American economy being based on consumer spending? It’s great that 70% of the American economy is based on consumer spending. That means that only 30% (more or less) of the economy is based on GOVERNMENT spending.

Although I actually think it is untrue that only 30% of the economy is Government spending. Obama just dumped a 2.8 Trillion dollar budget. With a GDP of 14 Trillion dollars, that is 27% of GDP right there, not counting state and local government spending.

No, no, no, join a credit union. Their interest rates on credit cards are still very reasonable. Most of them didn’t get caught up in the crazy loans, so they don’t have monumental debts to work off like citibank does.

Well, I agree, FOR NEW DEBT. But it should surely be illegal to raise the rates for old debt. Old debt should continue to be charged at the rate in place when it was spent. Otherwise it is a bait-and-switch scam.

Well, yes, but the downside is we would still be driving cars built by General Motors and the United Auto Workers.

Protecting domestic manufacturers only works if the government is honest enough to break up monopolies – and small groups of companies that act like monopolies (like “the big three”). And no government seems to be that honest.

And then there is the problem of unions. Union monopolies are as much a problem as corporate monopolies. Why should I feel any solidarity with someone in Detroit whose union has extorted a ridiculous wage and benefit package? He is exploiting me, right along with General Motors.

Well, it’s not very fair to change the rules AFTER you’ve run up the debt.

Some good points, Daniel. Only point I’d differ with is your definition of “services-based economy” referencing finance.

Financial “services” as an “industry” represented by the likes of Goldman Sachs, hedge funds, et.al. have proven to be services primarily for their management and shareholders bank accounts. The creation of ever-more exotic and incomprehensible “products” along with a corrupt financial “ratings” system are at the heart of our current financial meltdown, along with an “economy” based 70% on consumption. When the finance function rules over actual production of goods and real-value services (e.g. health care), you have a society on a downward slope to dissolution in favor of the super-rich…an oligarchy, or plutocracy not a democracy.

Sadly, that is the path we’ve been on for at least the past thirty years.

Now that’s creative thinking, Jake.

I can hear Faux Noise and the other corporatist media megaphones and infotainers yelling “Socialism”, ” Communism”, “Vegetarianism” and whatever other “ism” they can think of.

How about a tariff? How about capital controls? Where is it written that Americans exist to fight senseless wars. buy useless college degrees and drek made in China, chose one of two brainless and coopted major party candidates, permit wholesale looting of accumulated savings and destruction of our currency, all for the benefit of two hundred seventy thousand odd inheritors and a herd of phony pundits, captured economists, gangster ceos and moronic politicians? Do you really think labor’s future is wage competition with Chinese coolies? America has a history of class struggle. It was not finished by the election of the first Kennedy and is not diminished by the expiration of the last. Fifty years ago a corporate vice president made 5 times the income of a public school teacher. He also did 10 times the work, spent his life on airplanes, lived at the sufferance of corrupt bureaucratic bosses. But his entirely adequate suburban house cost 1 times his salary and he could look forward to retirement with dignity on a pension of $234 per month, until the day Haliburton and Bell Helicopter moved LBJ into the White House. They had owned him since 1930 and his Viet Nam war changed everything. including the value of money, which has now been reduced by a factor of 20.

“Let the market (people) decide what a fair credit card deal is and let the government stay out of it.”

1) It’s impossible for even intelligent people to completely grasp what’s going on, much less the ignorant and the flat out dumb. Hard for them to decide when they don’t know what they’re getting in to and the banks try to keep it that way.

2) Not when the money is coming out of the collective pool that productive activity has to be funded from and going straight in to the pockets of people who fund no actual useful production.

Actually, some evidence is that people stay current on their credit cards and default on their mortgage, particularly if they are underwater.

http://www.nypost.com/p/news/business/item_scI1spFMb60w5eeXXikODN;jsessionid=86B4BB5BF8632854FECC453FA5CCA9AB

I checked with Budget Auto Rental and they confirmed — you need a “major credit card” to rent a car at all the big auto rental companies. (i.e. not a local credit union card) Debit card won’t do even if you have a fat bank balance. Same probably goes for staying at hotels. Can someone enlighten me as to what other barriers a plasticless person faces? Are there any decent cash-only hotels, or does the cardless person have to sleep on a bench? No wonder the credit card companies can demand exhorbitant fees just so people can have a card. We are captive to the things.

Maybe we need some human rights laws, like those in place for religious freedom. We should be able to offer a bonding certificate proving we have good financial standing, and use that as a security in place of a credit card.

“Consumption Smoothing.” If you have a “reasonable expectation” of having more money, higher income, or lower expenses in the future, you can bring some of that future wealth into the present. Admittedly, a credit card is an expensive way to do so, but also a convenient one (one always pays for convenience). But this is the basic economic argument for all borrowing.

Of course, one person’s “reasonable expectation” is another’s “pipe dream.”

I like your ideas and would like to subscribe to your newsletter.

Everytime I hear “serious economists” sit around in a discussion, and a blue collar worker stands up and says “Free trade doesn’t work for the middle class anymore, how do we fix this problem”, every single “serious economist” just dismisses the poor blue-collar worker, never even addressing the issue seriously. Questioning free trade and globalization somehow became as rediculous as questioning gravity.

” How about a tariff? How about capital controls? ”

Because last time that kind of approach was taken, it resulted in a trade war and depression. And now, the chief target is China, who holds an enormous amount of US debt. If China feels the US is making economic “war” on it, it can retaliate by dumping some of its US debt onto the market and raising rates.

(And yes, that would damage the value of its holdings, but countries make sacrifices in conflicts.)

Or you can do what some immigrant families do — buy one monster-house and divide it up a bit and share it with the whole extended family, so that the grown kids and grandkids can save money until they can cash-purchase their own house, car, etc. Smart people.

Retroactive laws that punish voters? Possible, but not likely.

To make bankers rich.

Why not a federal sales tax instead? Encourage saving among the entire population.

. . to counter to a mass anti-bank movement, entirely likely. It would be called something like “financial terrorism” instigated by shadowy off-shore enemies.

deceptions, deceptions… I had just been a victim of one of these deceptive credit card practice. Here is the story http://www.mewithoutdebt.com/2010/02/credit-cards-and-asterisk.html

Jake,

Don’t give up. Lots of places to COMPETE with the corporatists you deride. Even with a cheap degree from a state school, I’ve managed over 25 years to work my way into Obama’s targeted tax bracket. Sadly, maneuvering the system counts for more of my time than ever today (instead of “what more can I do for you, Mr. Customer?), but this too shall pass. Only way to win is to stay in the game.

In reply to most here.

The problem with a green economy is they are only replacement jobs for less green technology. With international teams working on some of these products, it does not mean today the US will benefit from the jobs that will come as a result. If we were a less world economy, there would be a jump in jobs while both technologies were around at the same time until one died out. But currently, most of the jobs created are the service end — installation of the end green product.

The problem with a global economy where everyone competes for the same items to produce is eventually all standards of living will be raised resulting in others wages dropping or most likely stagnating until they become level. Briefly people can get around this by going to a University for that coveted piece of paper, but once everyone has one it will mean nothing. You would be better sending your children to trade school gaining a technical job and taking business classes as needed to then start their own shop selling product to those who are still looking for quality components, and trust me they are out there, because large companies have more overhead then the local shop and the non-Western overseas market specializes in mass production. As wages level, shipping and raw material will add to cost and it will be these established local plants that will be needed even more to make the more labour intensive parts based on the larger companies dropping acceptance rate of part failure.

Everything goes in cycles, based on about 30 year start cycles. In three hundred years this will make the history books as when Man grew up and again took pride in their work and what they produced. When we learned to buy products with care based on intended use, quality needed for that use, and other factors. Or it will be looked at as when the US chose to cry over spilt milk as the cat licked it all up off the floor; never thinking about how to get more milk.

This is why the university system is failing. It teaches careers and not how to think or how to look at real patterns. Instead we write legislation to keep the status quo and do not cut up our credit cards and tell the banks where to go with them (and for those who do not know a Visa backed debit card works for hotels and car rental — you don’t need the credit cards). The real law should be a usury law placing restrictions on interest rates. I argue that no house loan do to the length of time money is to be paid back under traditional 20 – 30 years loans should be more then 6% for the primary residence with 20% down, no car loan unless the quality goes up should be longer then 4 years and 7% as more risk is involved with depreciation and use (what the car companies offer is up to them), and credit cards 10 – 15% do to risk and it being unsecured. Banks must be Savings and Loans — nothing more. Size does not matter as long as investment is treated as savings and money is made from loans. Bank savings interest payments should reflect the amount of interest brought in by loans minus the cost of honestly running the bank with real wages for the tellers and no more then 10 times the wages of the lowest paid worker for the person at the top if you want to add ethics to the equation. Government then gets to do their job by making sure the dollar stays at a rate needed for our desired trade both export and import with little inflation, auditing banks to make sure they are not providing loans in an unsafe manner to the investors — those with savings accounts. Anything more is speculation and does not provide a safe banking system.

But what do I know about any of the above in the big players scheme of PhDs, big business, high finance, or government leaders as I will never be politically correct to speak with a forked tongue nor religious enough for the masses to ever be elected for office. (The Economist said this summer only 6% would vote for a Free Thinker based on a poll that was given by some group who I forget and I will not pretend on this.) Thus, I am only a writer, an appointed town planner (who has to watch patterns), sheep and beef owner (who has to watch social patterns like religious holidays, international markets and trade to know when to sell and breed my animals for the best markets next year and how much grain to buy during a given time based on both prices and international crops. Plus, look at breeding smaller animals in the next few years that need less grain to finish as other countries with large populations are buying grain for their people suggesting not all is gong well in those countries as the need for government bought grain should go down if the people are doing well selling goods to the West – unless they are stockpiling it for when they reach the top of their population expansion before contraction expecting a rise in prices with demand.) But what do I know with 180 college credits and trained in the Liberal Arts of which these credits are divided mostly between Archaeology (where social and trade patterns can be watched for years at a time), history (where social and trade patterns can be watched for years at a time), the basic theories of Economics macro, micro, and international. The reading knowledge of four dead languages to read how past cultures looked at trade and their ideas on why things were, plus how their works are worded in various cultures in the original texts. But as I said, what do I know….

You’re all missing the point. The problem is not the bank, its the consumer. Don’t spend money that you don’t have, then credit card APRs don’t matter. Its very simple.

Thanks for all the intelligent and thought-provoking answers to my questions above.

Jake Chase writes: “No doubt there is an excellent reason why banks borrowing from the Fed at .01% must charge 29% on credit card loans in order to make ends meet. …

As for a serious suggestion, why not simply put the Fed in the consumer lending business?”

Jake is right. When you look at the spread — .01% from the Fed (if that is not a joke) and 29% plus “fees” — there is no reason why the government should not get into the lending business. The condition being there are regulations and safe guards in place to prevent politicians from intervening on behalf of friends and constituents. (I think it might be called Crony Capitalism).

Which brings us back to — bank nationalization — the hot topic in the middle of the financial meltdown and the bane of all rent-seeking financial institutions.

Grrrrrr ….

I believe Jake Chase lives in Palm Springs [?] Maybe he has neighbours who are so fed up they would back the idea of bank nationalization. I am sure they (Jake included) would have the technical know-how create a few nationalize banks for some real competition.

Great comment

ditto

“I’ve been running around asking this question since my teenage days.”

Grrrrr … like maybe the policy makers and macro economists and technocrats should get with it

60% interest IMHO is scandalous … no one should be allowed to lend at that rate

I am not sure anti-usury laws in Canada are all that great

Citi is a Zombie Bank … they are just treading water and delaying the inevitable …

Thanks Mike … maybe “redemptive technology” has a chance if we can get a grip on the fact “limitless growth on a finite planet” is a logical fallacy.

Well put, RB Shea. Didn’t mean to imply that we should have done what we’ve done with the growth of the financial services sector, only that finance happens to a dominant service we’ve ended up coming to depend on for growth. And as you alluded to, it’s precisely this imbalance between consumption and production in the American economy (whose effects have only been made more painful by the financial meltdown) that’ve put us on the path we’re on to to an ever-increasingly inequitable oligarchy.

It’s very sad , but I remain an optimist…

Fighting the banks with more federal regulation is a losing strategy.

Even if Bernanke is able to strike this particular practice down, a thousand more like it will take its place.

Even if they pass, how long do you think these regulations are going to last? 6 more years at most? If the democrats don’t wimp out first, the banks will just strike it down again once they get the republicans back into power.

In Seattle, as well as in other cities, working class people like myself have won better mortgage deals and interest rates for ourselves by taking the fight directly to U.S. Bank and Bank of America.

We’ve organized pickets and disruptions of the local bank offices and won all of the demands we’ve fought for so far.

Stop relying on the Democrats.

When the govt sends a check to soc sec recepients, the govt is not purchasing anything (spending). The recipient spends the money.

So if 2.8 T is 27% pct of the economy you need to net out transfers. If consumer spending is 70% of the economy gov spending must be much less as business sector spending needs to co-occupy the 30% with the govt.

In every state in the U S it used to be illegal to charge more than 8% interest on loans, otherwise it was deemed to be usury. The penalty for violating this usury law was the forfeiture of both the interest AND THE PRINCIPAL of the loan. Are Credit Cards exempt from this today and if so, why?

No one should carry a credit card balance…

Spending money you don’t have (and thus borrow from the credit card company) is reckless. Besides the high interest rates (comparied to ZERO interest if you save the money first), it puts you at the mercy of the credit card company.

Credit card terms are subject to change at very short notice and your only recourse to escape the changes is to pay the card off. You can’t count on being able to roll them to another card. So sanity requires you to be able to pay the full amount off

at any time.

So there really isn’t any point to paying interest on a credit card as to use one responsibly you have to already have the money. Why pay the interest?

I don’t see any problem with using a credit card as a payment mechanism — but pay it off before any interest is due.

http://www.bankrate.com/brm/news/cc/20020320a.asp

this happend in every country some more some less, I think that robert kiyosaky explain better this, if you are going to ask for credit, if is to get pasive, then pay fast if you are goingt to buy active, take your time and pay over the time.