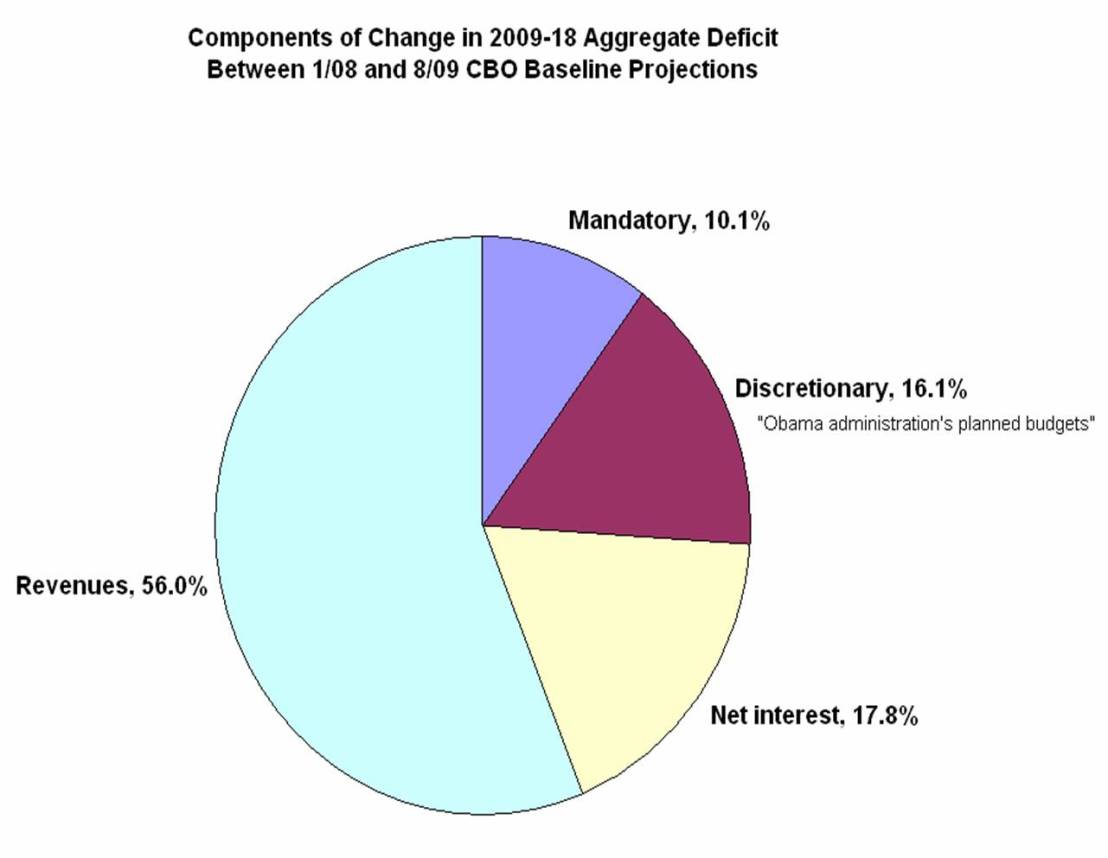

A couple of weeks ago I did a a basic calculation to see why the medium-term national debt picture has gotten so much worse in the last two years. There’s no new data I created; it’s just the difference between the January 2008 and August 2009 Congressional Budget Office projections. Here’s the chart, once again:

The Center on Budget and Policy Priorities (hat tip Ezra Klein) has done a similar exercise using CBO data, except they are looking at the annual deficit, not the aggregate deficit over a decade. Here is their chart:

The Technical Note to the CBPP’s report shows how they came up with the numbers. For the most part they are using CBO estimates. They allocate debt servicing costs to the programs that led to increases in debt servicing, which seems reasonable to me. (The CBO usually leaves debt servicing as its own line, which is why I left it as its own category above.) The only questionable bit of methodology I can see is that they count AMT fixes (during the Bush years and going forward) as part of “Bush-era tax cuts”; arguably those should be part of the baseline (“Deficit without these factors”). On the other hand, the CBPP left out the Medicare prescription drug benefit (the major domestic program of the Bush era) because of uncertainty over how big a hole it will create.

When told that the recent change in our overall debt position is primarily due to lower tax revenues, not higher spending, even some people who really should know better are surprised. Similarly, many will be surprised to learn that our trillion-dollar deficits are not due to increased spending under the Obama administration, and that the stimulus spending dwindles away quickly. And where’s health care? It’s not there because it isn’t in the CBO’s baseline projections yet, but in any case the CBO projects it as net deficit-reducing over ten years (and beyond, for the Senate bill).

Klein reports that the Republicans are not going to provide a single vote to raise the debt ceiling this week, forcing a 60-40 party-line vote in the Senate, so they can use the deficit as a campaign issue next year.

By James Kwak

I apologize if this is too off-topic, but i couldn’t find a way to submit it offline. I would very much appreciate a post and discussion of Turner-Brown and similar proposals to tax short-term financial transactions. I’m curious if it’s not been covered because the sense is it’s just talk and will never happen…

Thank you for all your good works!

James — this is off topic too, but a different alyosha makes a good point. I wonder if you would consider creating a way for your readers to suggest topics of discussion. Thanks!

Could the lower tax revenues be related to the expenditure side?

It would be helpful, for more than just figuring out how badly Bush hurt the country, to see an estimate of the deficit “without these factors” including the AMT fix. Any chance? By the way, thanks for going through the methodology. When I say the charts, that was my first question.

Thank you for submitting this analysis. It makes the picture distressingly clear.

As a Christmas present, I would like to thank Simon and James for this excellent blog. I was “angry but largely uninformed” before I started reading this blog. Thanks to both of you for providing this wonderful service to the people of this country.

Please try to get this chart published in a national newspaper.

Happy holidays. May whichever deity you choose to believe in walk with you.

If you f..ing cut taxes and go ape-sh.. on the spending you’re gonna get a big f..ing doghnut. Simple as that. Thanks. I’ll be in town all week.

Um, why does the “economic downturn” extend through 2019?

My reading of the CBPP chart says that the only thing increasing the deficits through 2019 is the Bush era tax cuts. If we let them expire (as they are scheduled to) we will not increase the deficit and it will remain stable from about 2014 on- in fact I would predict it would actually go down. Sounds great to me. Am I missing something (assuming the ATM fix is not the major contributor which I doubt).

Since August 15, 1971, when President Nixon closed the gold window and the world went on a fiat regime, the rules regarding government finance changed completely. Now a sovereign government that is the monopoly provider of a non-convertible floating fx currency of issue is not financially constrained. It does not need to borrow or tax in order to finance its spending, including servicing the national debt. It’s only constraint is real in that if nominal aggregate demand exceeds real output potential, then inflation will rise (not otherwise). When the economy approaches capacity, then the government must either cut spending or raise taxes to withdraw net financial assets from the economy.

On the federal government as currency issuer can expand and contract the net financial assets of non-government. Commercial banks cannot increase of decrease net financial assets since all their transactions net to zero.

This means that when the public desires to save, especially when the country is running a CAD, and business investment is insufficient to fill the gap, then an output gap will result, along with rising unemployment. Unless the government steps in to add net financial assets sufficient to close the gap, there will be an output gap and rising unemployment, and the economy will contract.

Yes, if a government is profligate, then its currency can decline relative to others, but that gives it an export advantage, too. (BTW, anyone who is afraid that the dollar is going to zero anytime soon can send them to me. I’ll pay the postage.)

Talk about deficits impacting the economy independently of other conditions is misplaced. Deficits are neither good or bad, too big or too small independently of other factors.

The notion that sovereign government that are currency issuers in a non-convertible floating rate regime can go bankrupt, run out of money, become insolvent, or default on their debt is like thinking that scoreboards are limited in the points that they have available. This thinking is a holdover from the previous convertible fixed rate regime, and it is no longer applicable because that’s just not how the monetary system works.

(PELLEY) Is that tax money that the Fed is spending? (BERNANKE) It’s not tax money. The banks have– accounts with the Fed, much the same way that you have an account in a commercial bank. So, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed.

When the government wants to spend, the Fed simple debits the Treasury’s reserve (deposit) account. Government borrowing simply clears excess reserves so that the Fed can hit its target (FFR) rate, and there are other ways it could do this, so borrowing is not even necessary at all. Balancing spending with $ for $ borrowing is a voluntary constraint imposed on the system politically that has nothing to do with how the system actually works in practice.

Regarding the US, all this dance about “unsustainable” deficits, “unfunded obligations,” sovereign default, etc, is just kabuki detached from reality. However, it should be noted that the countries of the European Economic Community (EEC) gave up monetary sovereignty, so they can individually default on their debt if not bailed out by the European Central Bank (ECB). US states are in the boat with respect to the federal government as currency issuer, since they are currency users, like households and firms. (Of course, they could use IOU’s as state money if they accepted them in payment of state taxes.)

Tom: Thank you for injecting some sanity into this discussion

So this is the Republican governance philosophy: break the budget and blame the consequences on the Democrats. The devil take them.

I find this approach perplexing and maybe even disingenuous. As though the deficit, spending plans, and tax revenues sprang anew from whole cloth in 2000.

Of course net tax reductions of any kind will increase the deficit, if spending is held constant or grows. Instead of or in addition to the Bush tax cuts, we might have included the tax cuts and hikes of every other administration since the Articles of Confederation. Then we could all argue equally senselessly about whose fiscal policy caused the deficit or saved us from deficits.

To evaluate the significance of these charts in the here and now requires analysis of the benefits of reduced taxes (i.e. more investment, spending, and money in the hands of the public) vs. the benefits of planned increases in government spending – the so-called “entitlements” as of now.

Do all readers of this blog share the assumption that substantial growth in Social Security and Medicare spending is desirable and of greater benefit to society than cash in the private sector? Do all readers of the blog share the assumption that tax cuts are of no benefit to the economy?

Like the initial projections for Medicare and Medicaid these projections are a bunch of non sense.

Terrific post. I’ve said before I think this is an issue that cannot be run into the ground (reiterated to infinitum) enough. If The Democrats were smart they would take the Graphs that James Kwak made and in their 2 minute floor speeches or any daily speech, present it and discuss the extreme hypocrisy of Republicans on this issue for decades, it goes back to roughly 1981.

Or the Democrats could take the graphs made by the St. Louis Federal Reserve and quoted by Hale Stewart of HuffPost found here http://www.huffingtonpost.com/hale-stewart/ronald-reagan-fiscal-dis_b_82370.html Just do it in more colorful and presentable way on the Senate and House floors with specific years clearly identified. Most likely they’ll just stand there like apes scratching their underarms while the Republicans try to rip them to shreds on the issue.

I want to wish everyone a Merry Christmas (And Happy Hanukkah if the 8 days are still going). I found if you forgot what Christmas is about it helps to read the beginning of Matthew or the beginning of Luke in the Bible. And if you like Classical music during the holiday you can try this link. After the jump click on the left where it says “listen”.

http://www.kcscfm.com/ Merry Christmas!!

I’ll add to RK – I was underinformed before i started readign here daily – and it makes a real gift that keeps on giving. Happy Holidays!

Sure sounds, acts and looks like “Starve the Beast” to me.

Tax cuts do not, based on a pleuthora of published reports, have benefit to the economy. That’s Laffer Curve theory, and while it can be an interesting cocktail party discussion, there’s no real world evidence to back it up. In fact, if you look at the top marginal tax rate

for personal income throughout its history, you will see that it RISES each and every time we climb out of a recession.

That’s a separate issue, however, then whether and to what extent entitlements influence deficits. Their influence exists primarily in the squeezing of discretionary federal expenditures. In otherwords, if tax revenue remains neutral or decreases, and entitlements increase, then discretionary spending either has to go down, or go into deficit mode to remain constant. Where we run into problems is the notion that we can have expanding entitlements, expanding discretionary federal spedning, and lower taxes.

Great Post! Dean Baker also had some great stuff on the deficit on his blog: http://www.prospect.org/csnc/blogs/beat_the_press

10-year projections are meaningless! (Remember, CBO was projecting budget surpluses for this decade 10-years ago?) First show me an accurate 5-year or even 2-year projection…

Wow, no bias in these reports…

In addition to the AMT fixes falling under the ‘Bush Tax Cuts’ as James poits out the CBPP also extends these taxes even though they are going to expire,

“Specifically, our baseline assumes that Congress will continue the 2001 and 2003 tax cuts that are scheduled to expire after 2010” wouldn’t that make them the Obama extension of the Bush Tax cuts vs the Bush tax cuts?

So has there been a study on how accurate CBO projections are? Oh don’t worry about this from the CBPP either, “Part D outlays are coming in lower than CBO and the Medicare actuary expected, but it is not possible to update the original price tag for the entire MMA.” Yeah we were way off, but are going to use these way off projections because we don’t know why we were way off. Makes sense to me!

A startling factor depicted in the second chart is this: The larger and larger amount of blue not only indicates that a larger amount of the revenue loss comes from not taxing people in the higher brackets, but that the pojection (as the flat-lined economy seems to continue, and I don’t argue) indicates a growing portion of those continuing to pay less taxes. And, furthermore, this whole post tend to shoot holes (or throw bombs by its dramatic revelation) at those who would claim that increasing taxes will put the kibosh on future growth. That, of course is, and always will be, an elitest argument, since we had growth in the 50’s, and the highest rate was 90%.

I second Francois’ request.

Isn’t a portion of the debt attributable to the decrease in tax revenues caused by recession?

The charts shown are more than useless as they are static in their estimates of the effects of the Bush tax cuts. If the effects were static and only caused falling revenues then why did the deficit go down every year under Bush until 2008 when the financial panic hit?

People and business do react to changes in the tax code as well as various uncertainties. We are not dumb players to be acted upon by greater forces but active participants in economic life as can be seen by the dismal recovery currently resulting from the huge clouds of uncertainty being raised by the Obama and Democrat congress.

<>

The problem with this argument is that while top rates were nominally higher, actual rates were not. There were so many deductions and tax shelters available that the high income earners paid less in tax before the Reagan reforms than after. A fact obfuscated by the Democrats of the time demagogueing the issue with blatant lies.

My mother was a national partner with Seidman and Seidman, at the time the largest US accountancy firm, and ran the US Virgin Islands office. The US Virgin Islands had, at the time, a mirror tax code of the US but administered the enforcement with local staff who were far less competent than their mainland counterparts. The USVI, therefore, became it’s own little tax haven as the very wealthy could live there a few months out of the year, claim residency and file in a place almost anything went. My mother used to bemoan the fact that her hugely wealthy clients were now paying so much more under the Reagan tax cuts due to the loss of the numerous dodgy shelters they previously used.

And so, as with Bush, these “tax cuts for the wealthy” actually resulted in INCREASING revenues from the rich a fact the Democrats and the media choose to ignore although easily verifiable through IRS statistics .

I really do not care who has done the spending. Clearly there need to be spending cuts now. It is not useful to say this president vs that president. It is useful to do the right thing. right now that would be to reduce spending.

Yes, thank you.